The market is closed on 15th April (Good Friday)

The growth stocks – small and large – took it on the chin this week, as the 10-yr yield jumped 34 basis points to 2.71%. The Nasdaq Composite (-3.9%) and Russell 2000 (-4.6%) fell more than 3.5%, and the S&P 500 fell 1.3%.

The short holiday week in the US will be dominated by the start of the earnings season, with U.S. inflation data due. Inflation could hit fresh highs, while bank earnings are expected to decline.

Meanwhile, investors will be keeping an eye on market volatility driven by the developments in Ukraine.

Here’s what you need to know to start your week.

1. U.S. CPI

February’s consumer price inflation reading of 7.9% was the largest annual increase in 40 years and U.S. data on Wednesday is expected to show that CPI rose by an annualized 8.5% in March as the war in Ukraine sent commodity prices sky high.

A strong inflation reading would bolster the case for more aggressive rate hikes by the Federal Reserve, likely adding to investor concerns that tighter monetary policy could act as a drag on the economy.

The Fed hiked rates by a quarter of a percentage point in March and last week’s minutes from that meeting indicated that more substantial rate hikes and a balance sheet runoff are probably on the cards in the coming months as policymakers try to prevent high inflation from becoming entrenched.

2. Bank earnings

Big U.S. banks will kick off the Q1 earnings season this week and analysts are expecting financial sector earnings to decline from a year ago. Investment bank revenues are taking a hit in the wake of Russia’s invasion of Ukraine, while some banks are making provisions for losses related to Russia.

JPMorgan ($JPM), the largest U.S. bank, is reporting on Wednesday, while results from Goldman Sachs ($GS), Morgan Stanley ($MS), Citigroup ($C) and Wells Fargo ($WFC) will follow on Thursday.

Bank shares have performed badly so far this year, losing 11% against the S&P 500‘s 6% decline.

Bank executives will likely be pressed for their view on whether the U.S. economy can continue to grow against the background of the economic fallout from the war in Ukraine and a more aggressive Federal Reserve.

Key Economic Calendar (Weekly)

Aside from the CPI numbers, the U.S. is set to release data on producer price inflation on Wednesday. The latest figures on initial jobless claims are due for release on Thursday along with data on retail sales and consumer sentiment.

All times listed are EDT

Tuesday

8:30: US – Core CPI: probably remained flat at 0.5% MoM.

Wednesday

8:30: US – PPI: to advance to 1.1% in March, from 0.8% previously.

Thursday

8:30: US – Initial Jobless Claims: expected to rise to 173K from 166K.

8:30: US – Retail Sales: anticipated to have doubled to 0.6% from 0.3% in March.

Friday

Good Friday Holiday: US, UK, Eurozone, Australia, New Zealand and other global markets closed

Top 3 Leading and Lagging Sectors (Weekly)

The S&P 500 information technology (-4.78%), consumer discretionary (-4.27%), and communication services (-3.25%) sectors, which are home to the mega-caps, were influential weights on the benchmark index. The industrials sector (-3.23%) was also weak amid continued bleeding in the transportation space.

Conversely, the energy sector (+1.98%) joined the defensive-oriented health care (+2.64%), consumer staples (+2.01%) and utilities (+1.41%) sectors in positive territory for the week.

Market Breath (Weekly)

% of Stocks Above 50 DMA = 44.12% (-23.87%)

% of Stocks Above 200 DMA = 34.64% (-13.18%)

Market Technicals – (S&P 500, NASDAQ, Bitcoin, Bonds & Credit Spread, NAAIM)

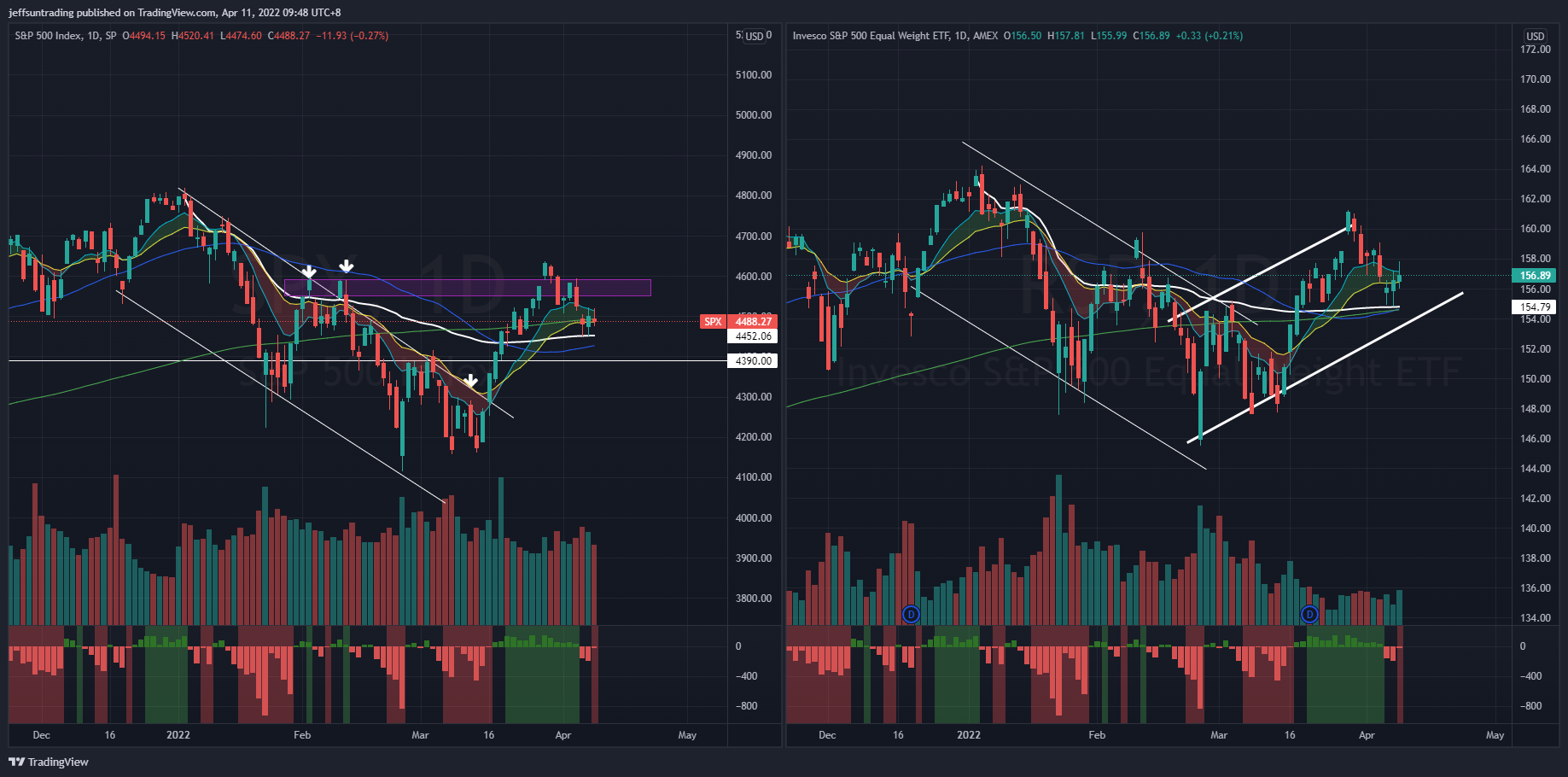

$SPX (S&P 500) vs $RSP (S&P 500 Equal Weight) – (Net High/Low -13)

The S&P 500 ($SPX) fell -1.27% last week, sitting on its volume-weighted average price (VWAP) from all time high. The same is also observed on $RSP.

$SPX is currently displaying a bullish High Tight Flag formation (HTF), setting up for another leg of short term rally potentially. Major moving averages of $SPX is also currently in coiled notion as convergence of the moving averages are observed week on week basis.

The immediate support to watch for $SPX this week remains at 4,390 level, a level that would undercut all major moving averages and volume-weighted average price (VWAP) from all time high, also coinciding with a major horizontal support.

$QQQ (Nasdaq 100) vs $QQQE (Nasdaq 100 Equal Weight) – Trend Reversal In Play, Strength at 200-Day Moving Average

Tech and growth names have been hard hit since the start of 2022 by a rapid rise in Treasury yields on the back of expectations that the Fed will hike interest rates aggressively to combat high inflation as higher rates can hurt their companies with high valuations based on the prospect of future profits.

$QQQ fell -3.51% as the 10-yr yield jumped 34 basis points to 2.71%. The primary catalyst for interest rates was Fed Governor Brainard’s (FOMC voter) expectations for the Fed’s balance sheet to shrink considerably more rapidly than in the previous recovery, starting as early as May.

$QQQ is currently below its declining 10 and 20-day moving averages, exhibiting further short term weakness as its continues to play out the highlighted trend reversal Double Bottom formation from middle of March.

The support level to watch for $QQQ this week remains at $340. Similar to $SPX, this is a level that undercuts all major moving averages which coincide with previous support level.

$BTCUSD (Bitcoin / USD) – Bearish Head and Shoulder Pattern Remains Valid

Bitcoin ($BTCUSD) fell -9.20% last week, resisted by Its 200-day moving average as highlighted last week.

The next level of support to watch for $BTCUSD is at $41,700, a level that undercuts its last major moving average (50-day moving average).

$PCCE (Put/Call Ratio Equity) & $VIX (Volatility S&P 500) – Volatility Remains with $PCCE Uptrend Since January Intact

The spike level to watch for $PCCE in the last 24 months period is at 1.00. The current reading of 0.786 (+0.25%) reflects risk-on sentiment of the market as it remains at a level of neutrality. However, $PCCE remains on short term uptrend since the start of 2022.

$VIX have also creeped up to 21.17 (+7.90%), displaying a similar uptrend to $PCCE that remains intact since November 2021.

$IEI/$HYG (Credit Spread) – $TNX (10YR Treasury Yield) – Yield at 3 Years High

Market participants are keeping a close watch on credit spreads as one of the better economic signals. Junk bond issuers are perceived to be bigger credit risks, so if economic growth slows or contracts, there will be increased angst that these issuers won’t be able to make good on their interest payments. Hence, a widening high-yield spread is regarded as a leading indicator of difficult economic times which, in turn, often invites a more challenging period for the stock market since difficult economic times translate into weaker earnings prospects.

Credit Spread increase to 1.50% over the week (+0.02).

$TNX topped to its 3 years high, pushed up to 2.712% (+0.336) as longer-dated rates were further boosted by the March ISM Non-Manufacturing Index, which showed the Prices Paid Index (83.8%) hit its second-highest reading ever.

Shorter-dated rates pushed higher, too, with the 2-yr yield rising ten basis points to 2.52% amid rate-hike expectations.

NAAIM Exposure Index 83.41 (+3.69)

The NAAIM Exposure Index represents the average exposure to US Equity markets reported by members of the National Association of Active Investment Managers. It provides insight into the actual adjustments active risk managers have made to client accounts over the past two weeks. The blue line depicts a two-week moving average of the NAAIM managers’ responses.

This week’s NAAIM Exposure Index number is: 83.41 further bouncing off from the extreme of 30.3 recorded in the first week of March.

Top Trading Ideas for the Week

$NEX is one of the strongest O&G runners when the industry group broke out of base in mid jan.

past 4 session went through a -10% correction with the latest pin bar posing a new opportunity for an entry based on mean revision setup

looking to bounce off its rising 20MA, again pic.twitter.com/yQkn9eqzz6

— Jeff Sun, CFTe (@jeffsuntrading) April 8, 2022

$KBR – displaying an ascending triangle pattern & HTF after surging +27% from its wedge breakout in feb.

range is tightening up over the past 3 weeks with the overall market weakness not reflected in this name.

strong growth in revenue numbers in both QoQ and YoY. pic.twitter.com/rQt2qQiTNP

— Jeff Sun, CFTe (@jeffsuntrading) April 8, 2022

$CCJ – addition to $DNN in my previous tweet, $CCJ is the strongest of all Uranium names currently.

already at 52 weeks high in both price and RS & a narrower correction range to its rising 10/20 MA. largest market cap of all 4 names at 12.1B (8 times the size of DNN) pic.twitter.com/JczrdWRGaC

— Jeff Sun, CFTe (@jeffsuntrading) April 8, 2022

$DNN – Uranium is the few industry group that you would probably find RS over the last 2 wks of market weakness. $UEC and $NXE have already taken off yesterday from their pivot levels.$DNN currently sits on its VWAP support from last ER, beneath a major pivot. ATR/$ at 7.17% pic.twitter.com/4435l7Q4PE

— Jeff Sun, CFTe (@jeffsuntrading) April 8, 2022

Do follow me on twitter for more daily trading ideas.