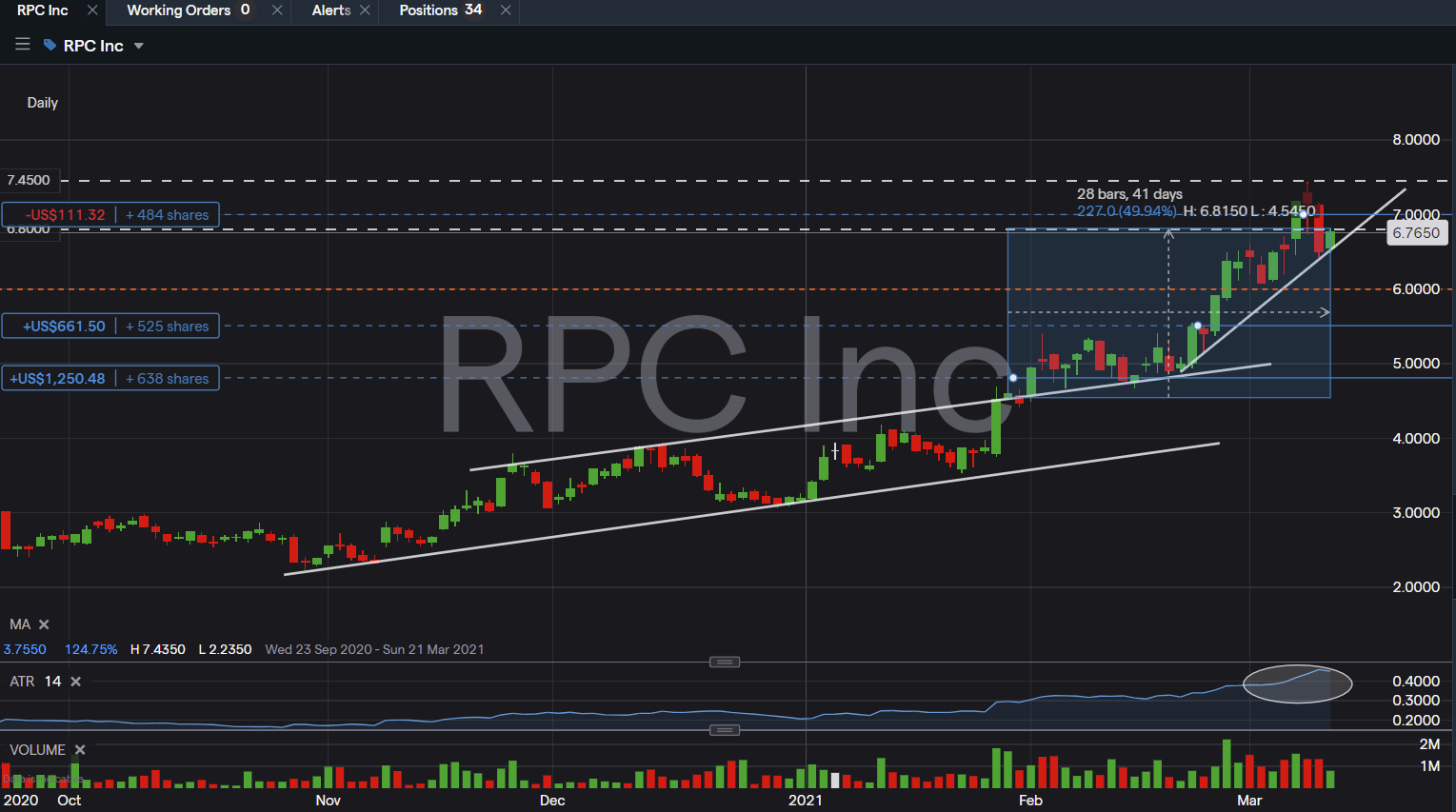

$RES rallied a further +3.99% to close at $6.77, putting it on a spotlight for a second re-test of its resistance turned support at $6.80 range that was highlighted previously. Wednesday’s closing affirms a higher angular (in momentum) trendline support for $RES, putting it in traction to re-test its Month’s high closing of $7.16 that was established during the opening of the week. The total cumulative rally from the breakout of its 3 months trend channel stance at +49.94% in 28 trading sessions.

Implied volatility of $RES have witnessed an increment to $0.45/day, a 28% increase in volatility of price action in 2 weeks. The breakout of $7.45 resistance will smoothly play out a long term trend reversal for $RES, confluence with a major MAs golden cross, with next significant levels to watch at $10.

$RES provides a range of oilfield services and equipment for the oil and gas companies involved in the exploration, production, and development of oil and gas properties.