US Markets will be closed on Monday in observance of Independence Day. Investors will be waiting for the FOMC minutes due on Wednesday for further clarification on the next monetary policy steps after a hawkish shift prompted market turbulence last month.

The benchmark index $SPX rallies furthered its all time high establishment, gaining +1.48% (+63.4 points) to close at 4,349 level during the week.

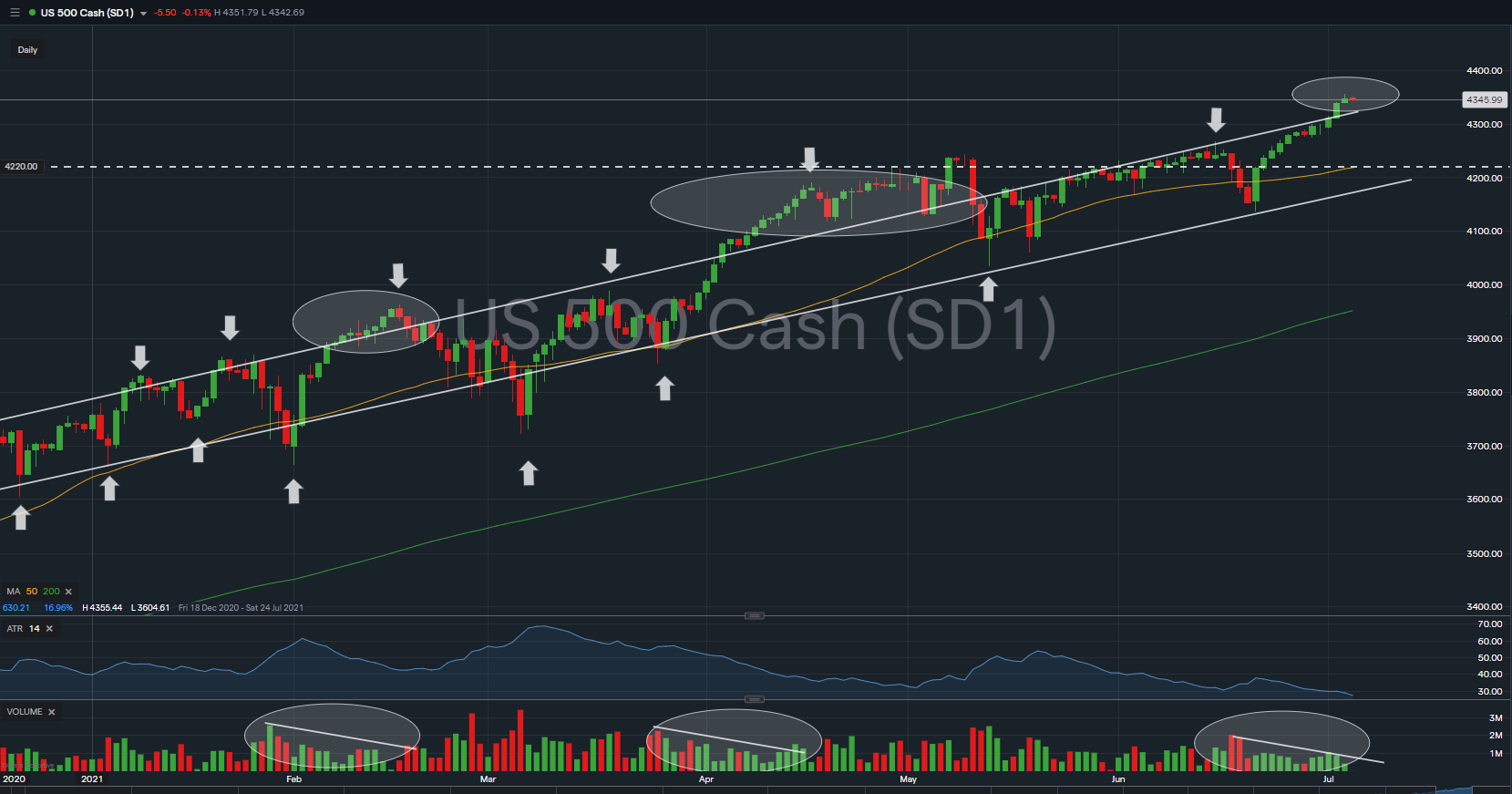

The price ascend have allowed $SPX to break out of its trend channel resistance for the 3rd time in since February 2021. It is important to remain cautious of the existing rally, as every breakout of the highlighted channel is met with price-volume divergence weakness, along with a correction towards its channel support.

The immediate support to watch for $SPX this week is at 4,220 level; a resistance turned support level, also an approximate of 4 ATR14 away from existing volatility, which is unlikely to be tested this week.

Fed minutes

The minutes of the Fed’s June meeting, when officials opened talks on tapering bond-buying and indicated interest rate increases could come sooner than previously anticipated, are due to be released on Wednesday.

The minutes are coming on the heels of Friday’s nonfarm payrolls report, which showed that the U.S. created the most jobs in 10 months in June, indicating that the economy closed out the second quarter with strong momentum as the reopening continued.

The robust data did little to ease concerns that a strong recovery and rising wages could prompt the Fed to begin unwinding its easy money policies sooner than expected.

ISM services data

The ISM index of service industry activity is set to be released on Tuesday and is expected to show continued strong growth after hitting a record high in May amid a reopening made possible by vaccinations against the coronavirus. The report could also underline ongoing labor constraints as hiring continues to lag, leading companies to offer higher wages to attract staff.

ECB minutes

The ECB is to publish the minutes of its June policy meeting on Thursday. ECB-watchers will also be on alert for news of several meetings due to take place in the coming weeks as part of the banks review of its monetary policy strategy.

The bank wants to revamp its inflation target – currently set out close to but not above 2% – and is aiming to get the review done by September.

On Wednesday, euro zone powerhouse German is to publish industrial production figures and the European Commission is to release updated economic forecasts for the European Union.

China inflation

China is to release data on both consumer price inflation and producer price inflation on Friday. Market watchers will be paying close attention to the cost of raw materials, which have soared due to higher commodity prices, and whether these increases are being passed onto the consumer.

Prices are jumping in China and around the world, adding to fears that a wave of inflation could threaten the global economic recovery if it continues.