Despite solid results last week as earnings season ramped up, investors have been shifting their focus to data releases with global economic growth beginning to show signs of fatigue while many countries, particularly in Asia that are struggling to curb the highly contagious Delta variant of the coronavirus. The spectre of elevated inflation, which the market has long feared, is also haunting investors. Treasury yields were plunging, signaling fearful investors are padding their portfolios with Treasuries.

The second-quarter earnings continues this week, with companies such as IBM ($IBM), Netflix ($NFLX), Intel ($INTC), Johnson & Johnson ($JNJ) and Twitter ($TWTR) reporting their results.

Other key data to follow include: US building permits and housing starts.

Here is what you need to know to start your week.

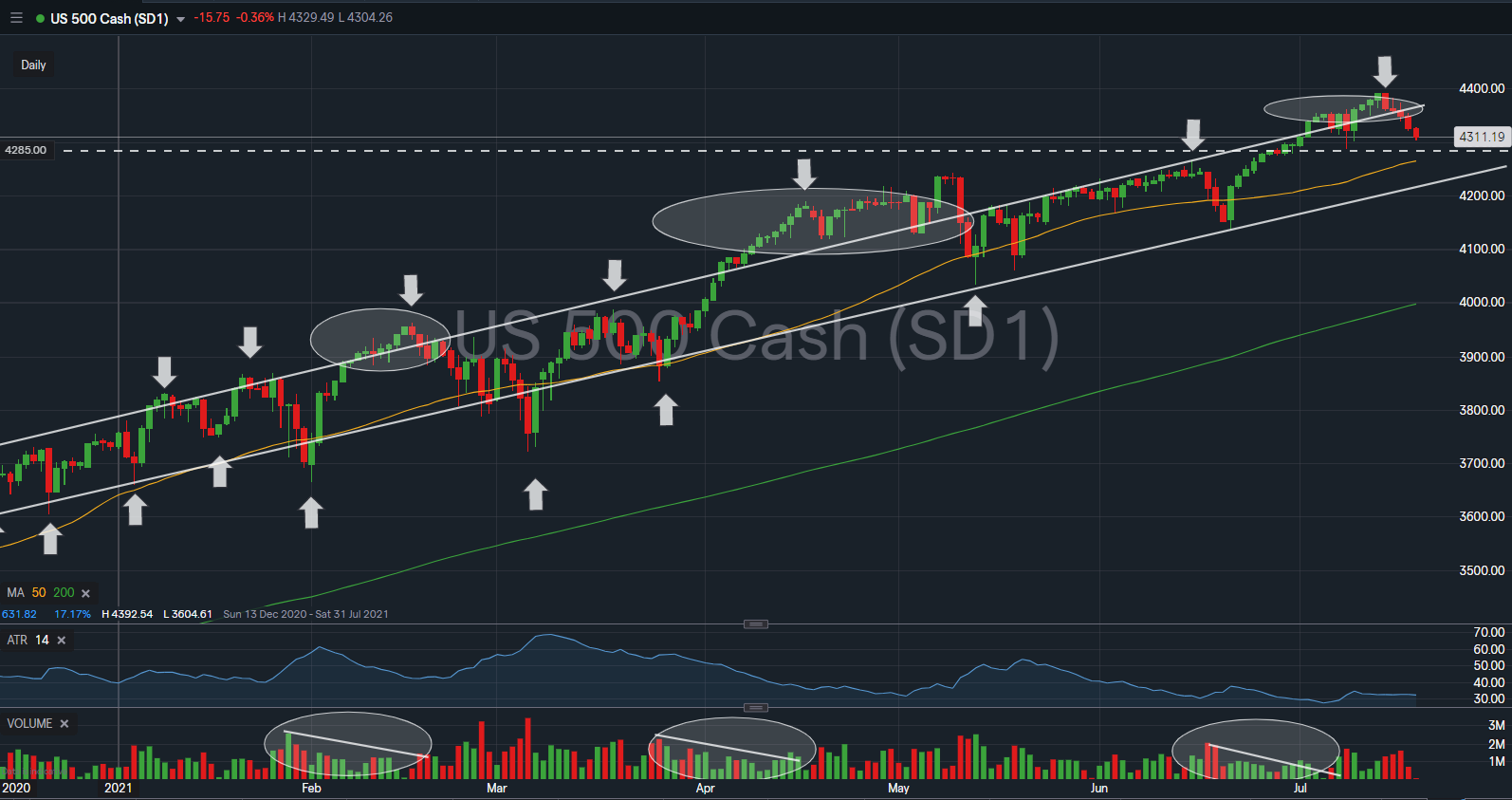

The benchmark index $SPX corrected -0.99% (-43.2 points) to close at 4,328 level during the week, and perceived safe haven assets, including the yen and gold, edged higher amid fears of rising inflation and a surge in coronavirus cases, while oil prices fell on oversupply worries.

The initial break out of $SPX trend channel resistance is met with rejection for its 3rd time as cautioned in the previous week. The channel support is currently priced at 4,240 level, -2% away from existing level.

The immediate support to watch for $SPX this week is at 4,285 level; an immediate break of support level established this month.