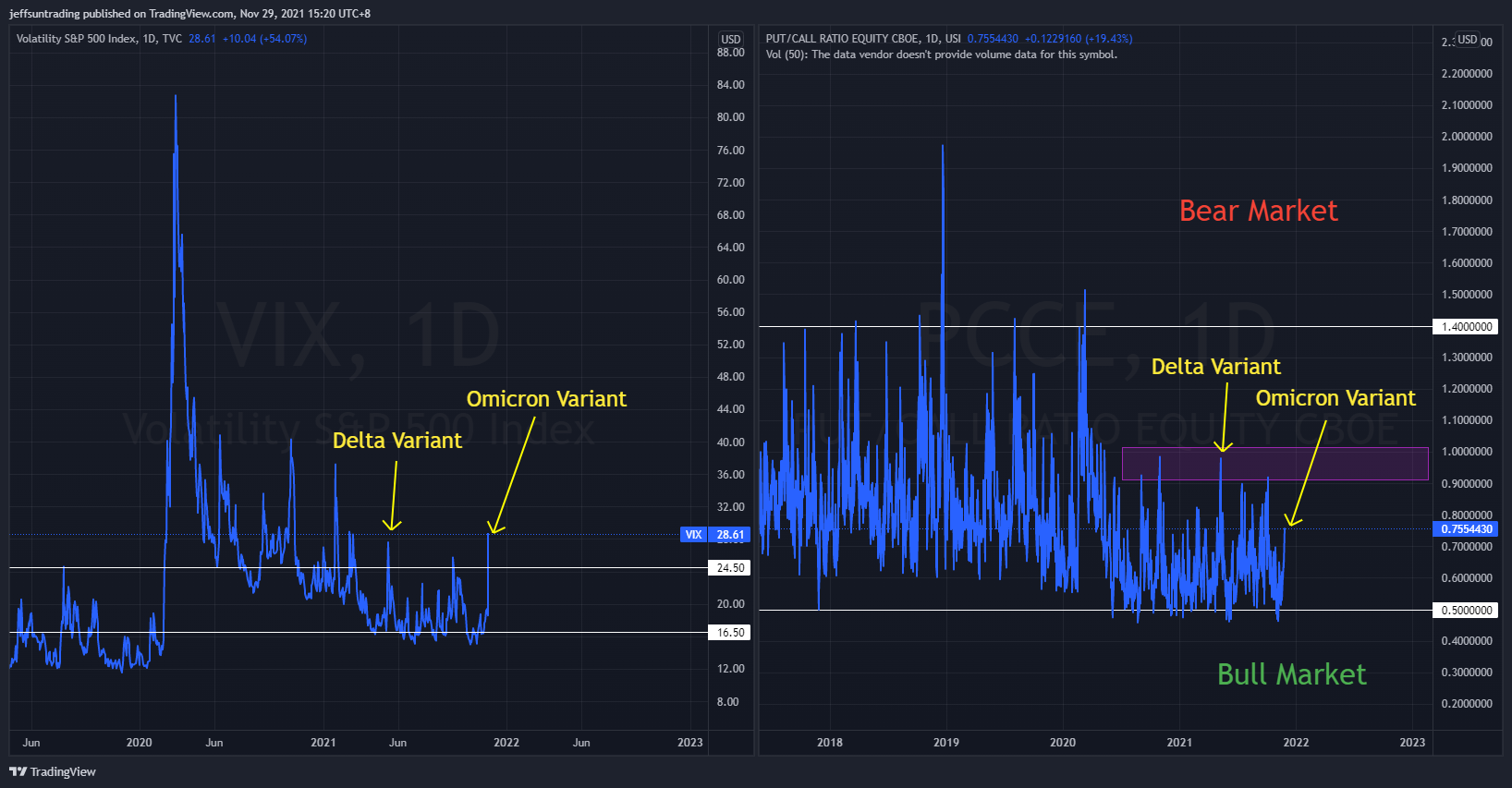

The big story on the emergence of a new strain of COVID-19 in South Africa caused Wall Street’s three main indices ($SPX, $NDX, $RUT) to tumbled on Friday as they re-opened after Thursday’s Thanksgiving holiday with energy, financial and travel-related stocks bearing the brunt of the selloff. The renewal or pandemic fear has outlined as the biggest risk to today’s market, and it is likely to inject volatility to the market for the remaining of the year.

Major indices dropped more than 2.0% on Friday, as investors sold risk assets. The $SPX fell 2.3%, the $NDX fell 2.2%, and the $DJI fell 2.5%. The $RUT 2000 underperformed with a 3.7% decline. WTI Crude Futures also fell -12.3% on Friday on worries of a supply glut.

With Equal-Weighted $RSP sitting at its 50DMA confluence with resistance turned support at $156 range, there is a significant representation of $SPX stalling its sell off for this week.

Last week’s leading sectors:

$XLU (Utilities) +3.76%

$XLP (Consumer Staples) +2.39%

$XLV (Healthcare) +0.98%

$SPX -2.20%

This week’s watchlist:

$MF, $PXD, $AA, $AMD and 55 more names.

The new variant strain may also raise doubts over how quickly the Federal Reserve can move to unwind stimulus to tackle spiraling inflation. Eyes will be turned to the US jobs report due Friday, which will probably point to a continued recovery in the labor market. Elsewhere, Federal Reserve Chair Powell testifies before Congress, while a highly anticipated OPEC+ meeting is expected to offer guidance into the coalition’s crude output plans.

Here’s what you need to know to start your week.

Market Technicals

$SPX (S&P 500) vs $RSP (S&P 500 Equal Weight)

The immediate support to watch for $SPX this week is at 4,585 level, a further break of the low of Friday’s lowest price action.

New pandemic wave?

Wall Street’s three main indices tumbled on Friday as they re-opened after Thursday’s Thanksgiving holiday with energy, financial and travel-related stocks bearing the brunt of the selloff, sparked by the discovery of the new coronavirus strain.

While little is yet known of the new variant first detected in South Africa, scientists said it has a high number of mutations that may make it vaccine-resistant and more easily transmissible than the Delta variant.

Before Friday, investors had been upbeat about the strength of the economic recovery amid broad vaccine availability and advances in treatments, despite fears over steadily rising inflation.

Jobs report

A robust November jobs report could underline the case for the Fed to speed up unwinding its $120 billion-a-month stimulus program at its next meeting in mid-December. But a fresh wave of the pandemic could throw those plans into doubt.

Concerns over spiraling inflation, coupled with signs of an accelerating economic recovery had prompted investors to begin pricing in a faster taper and earlier interest rate hikes.

Friday’s non-farm payrolls report for November is expected to show that the economy added 550,000 jobs, bringing the unemployment rate down slightly to 4.5%.

Powell and Yellen testimony

Fed Chairman Jerome Powell, fresh from his nomination for a second term by President Joe Biden, is due to testify on the CARES Act, the central bank’s pandemic-era stimulus program, before the Senate Banking Committee in Washington on Tuesday. Treasury Secretary Janet Yellen is also due to testify.

A similar hearing will be held before the House Financial Committee on Wednesday.

Investors will be looking for fresh insights on the outlook for the economic recovery amid renewed pandemic uncertainty.

Oil demand outlook

Oil prices plunged $10 a barrel on Friday, their largest one-day decline since April 2020, as news of the new Omicron variant saw countries rush to restrict travel, adding to concerns that a supply glut could swell in the first quarter.

The Organization of the Petroleum Exporting Countries and its allies (OPEC+) is due to meet on Thursday, after last week’s decision by the U.S. and other governments to release oil from strategic reserves in a bid to lower gasoline prices.

For its part, OPEC+ has stuck to monthly output increases of 400,000 barrels per day (bpd) since August, despite calls to increase output to drive down oil prices.