Wall Street’s main indexes posted solid gains with S&P 500 ($SPX) rising +2.28%, wrapping up the Christmas week at a closing record high amid buy-the-dip momentum. The Dow Jones Industrial Average ($DJI) also gained +1.65% while the Nasdaq Composite ($NDX) and Russell 2000 ($RUT) also churned out over +3% gains respectively.

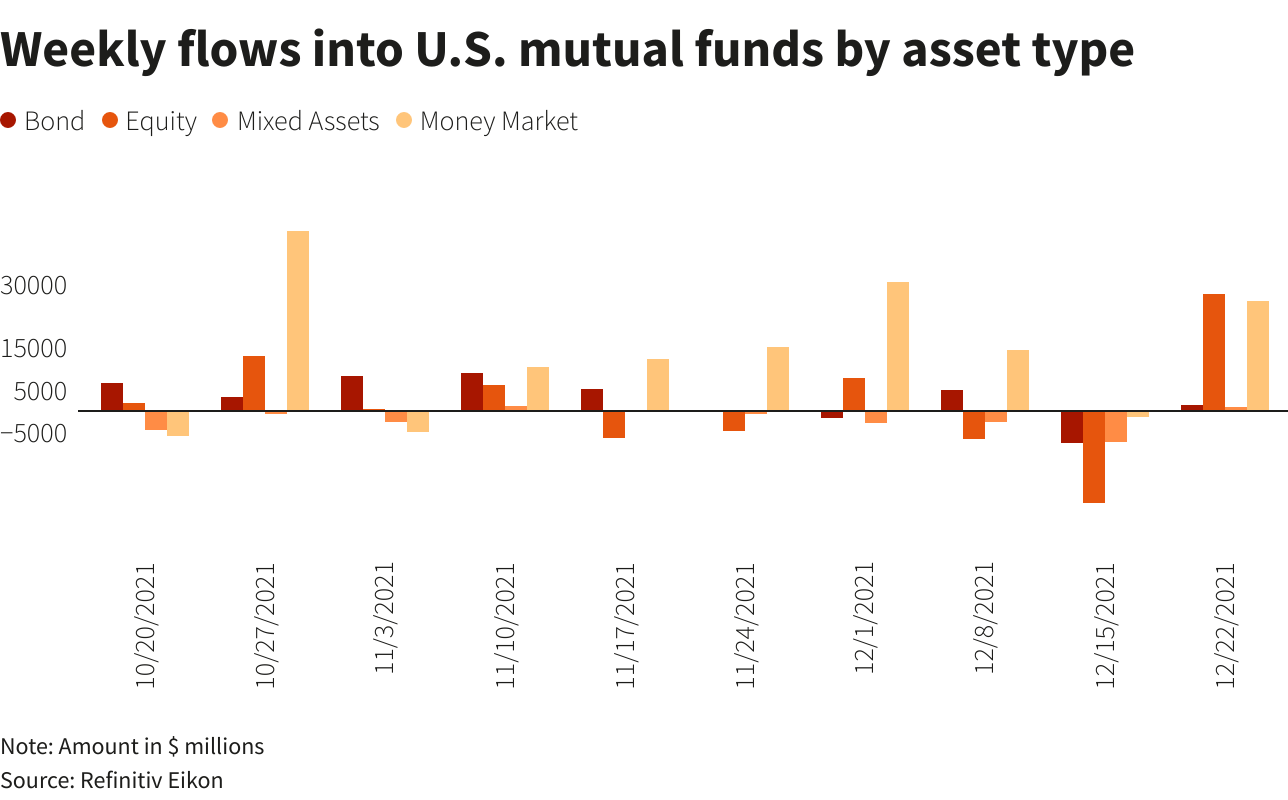

Additionally, we also witnessed the highest inflow of equity and money market funds in three months amid the development of Omicron virus.

Here is what you need to know to start your week.

1. Highest Inflow of Funds in Three Months

According to Refinitiv Lipper data, investors bought $27.55 billion worth of U.S. equity funds, and $22.96 billion in money market funds in the week alone.

2. COVID-19 (Omicron Variant, Possible Volatility)

COVID updates remains closely monitored by Investors for signs of how much the Omicron variant could impact the U.S economy and earnings. Research continued to suggest that the Omicron variant is milder than the Delta variant despite being more contagious. Despite the uncertainty around omicron, the bull narrative has been battered but is still the dominant narrative on the Street. It goes like this:

- ‘Omicron is highly contagious but for those fully vaccinated with a booster it is not as dangerous.’

- ‘There will be no mass shutdowns of the economy.’

- ‘The consumer indexes remains strong.’

Key Economic Calendar (Weekly)

The economic calendar is light for the upcoming next week, with market activity due to remain low as several bourses across the globe including those in the UK, Australia and Canada will remain closed on December 27-28 in the observance of Christmas and Boxing days.

In addition European countries trading ends early on New Year’s Eve.

The US market remains open for the full week into New Years Day (Saturday).

Monday

Markets closed for Christmas in Australia, Canada, the UK and other locations.

Friday

New Year’s Holiday; markets closed in Brazil, Japan, Singapore, Russia, Germany, Switzerland and the UK among others.

Top 3 Leading and Lagging Sectors (Weekly)

1. $XLY (Consumer Discretionary) +3.24%

2. $XLK (Technology) +2.33%

3. $XLC (Communication Services) +1.72%

$SPY +0.89%

1. $XLU (Utilities) -1.91%

2. $XLP (Consumer Staples) -1.65%

3. $XLF (Financial) -1.62%

Market Breath (Weekly)

% of Stocks Above 200 DMA = 42.92% (+12.92%)

% of Stocks Above 50 DMA = 37.38% (+40.16%)

Market Technicals (Rally Cycle Count: Day 4 of 25)

$SPX (S&P 500) vs $RSP (S&P 500 Equal Weight) – (Net High/Low +70)

$SPX posted a solid gain of +2.28% (+105.13 points), erasing the losses experienced in the earlier week. With $SPX closing at 4,725 level, it remains below its all time high level that have tested four times over the past 8 weeks. $RSP broke out of its downtrend line with a pop on the last trading session, minimising the divergence reflected in both the indexes that was highlighted in the previous week.

With both $SPX and $RSP also breaking out of its Anchored VWAP (AVWAP) resistance at 4,640 level, below average trading volume is observed on the subsequent two trading session during the course of the week; as market activity thinned towards the Christmas Holiday.

The immediate support to watch for $SPX this week remains at 4,600 level, creating a box range support beneath the confluence of major Moving Averages (10D, 20D and 50D).

$QQQ (Nasdaq 100) vs $QQQE (Nasdaq 100 Equal Weight)

The disparity between $QQQ (+3.12%) vs $QQQE (+2.67%) remains even in the week’s rebound. With $SPX and $RSP breaking out of their AVWAP resistance in the same session, $QQQE broke out of its AVWAP in a session later after $QQQ.

$QQQ is currently 2.89% off its high, and $QQQE is 6.28% off its high.

With $QQQE successfully rebounding off $81 resistance turned support level, the next support level is $84.65 AVWAP level. Holding off the aforementioned level will ascertain the sustainability of the rally in $QQQ.

$PCCE (Put/Call Ratio Equity) & $VIX (Volatility S&P 500)

The spike level to watch for $PCCE is at 1.00, where the current reading of 0.64 (-17.98%) reflects momentum in the current rally.

$VIX reading similarly declined to 17.95 (-16.82%) from 21.59 also confirming the rally we are experiencing over the past week.

$IEI/HYG (Credit Spread)

Credit Spread have declined to 1.48% from 1.50%. A further decline to 1.47% range will a spread level that was last witnessed some 22 months ago.

Trading Ideas

$OVV rebounded at 200DMA. still in a HTF consolidated range below AVWAP but definitely looks promising. will discard this from watchlist if 200D does not hold in near term pic.twitter.com/vR5fJtEOkB

— Jeff Sun, CFTe (@jeffsuntrading) December 26, 2021

$HMHC earnings gap supported with a high volume hammer candle. RS reflected as it remains supported within its 6 months trendline.

currently trading above AVWAP resistance, sitting on pivot. actionable trade for the coming week pic.twitter.com/547NDtHWt6

— Jeff Sun, CFTe (@jeffsuntrading) December 26, 2021

$HLTH IPO Base pattern. relatively decent RS, trading below IPO AVWAP.

actionable trade for the upcoming week as it look poised for a breakout at $13.60 pic.twitter.com/PYwkmBgU2c

— Jeff Sun, CFTe (@jeffsuntrading) December 25, 2021

Do follow me on twitter for more daily trading ideas.