The major indices ended the last week of 2021 on a mostly positive note, particularly for the S&P 500 ($SPX) and Dow Jones Industrial Average ($DJI). Both gained around 1.0% and set intraday and closing record highs for the week. The Nasdaq Composite ($NDX) declined -0.1% while the Russell 2000 ($RUT) increased 0.2%.

An OPEC meeting may be the headline event for the week and the one that has the biggest impact on the year ahead. Crude Oil WTI finished its best year since 2009 and Brent its best year since 2016.

While it’s not quite earnings season yet, we also have a few corporate earnings this week. Walgreens Boots Alliance ($WBA), Bed Bath & Beyond ($BBBY), MillerKnoll ($MLKN), WD-40 Company ($WDFC), Constellation Brands ($STZ), and PriceSmart Inc ($PSMT) are among the earnings reporters this week. This week will also see the publication of the FOMC meeting minutes and the US jobs report, which could provide further clues on the timing of the first rate hike by the Fed.

Here’s what you need to watch for in the first week of 2022 in financial markets:

1. December Jobs Report

The U.S. Jobs non-farms payrolls report comes out this Friday. Expectations are for a growth of 400,000 jobs, vs. 210K last month and an average of 494K jobs added in the last six months. The unemployment rate is expected to edge down to 4.1% from 4.2%.

Unemployment is the flipside of inflation, at least in the Federal Reserve’s estimation and aims, so a strong report would give more room to the Fed to proceed with rate hike and policy tightening plans. At the same time, the last report that came during a big Covid-19 wave – the August and September reports overlapping with the Delta wave – came in light at least in the initial read before the numbers were revised upward. While few new restrictions were put into place in response to the latest wave from the Omicron variant, consumers’ behavior changing and the raw fact of hundreds of thousands of people being sick may weigh on the numbers.

2. OPEC Meeting after a stand-out year for Oil

The Organization of the Petroleum Exporting Countries (OPEC) meets on this Tuesday. At their previous meeting, OPEC reaffirmed their decision to increase oil production in 2022 and said that they expected a low impact from Omicron on demand for oil. With a month more data – which includes record cases and a bevy of flight cancellations on the one hand, but a not quite clear consensus that this variant’s effects are milder than previous incarnations of Covid – we’ll see whether OPEC holds the line, as expected, or alters its outlook and production schedule in any way for the year ahead.

Oil finished the year up over 50%, with Crude Oil WTI having its best year since 2009 and Brent its best year since 2016, and the recovery of demand to pre-pandemic levels this year is expected to support the price of oil even with OPEC’s production increases.

3. Retail, Office, and Industrial earnings this week

While Q4 earnings season tends to be the slowest to kick off as companies close their books for the year, we get a few off-cycle reports this week to work through.

Walgreens Boots Alliance ($WBA), Bed Bath & Beyond ($BBBY), MillerKnoll ($MLKN), WD-40 Company ($WDFC), Constellation Brands ($STZ), and PriceSmart Inc ($PSMT) are among the earnings reporters this week.

Key Economic Calendar (Weekly)

2022 kicks off with a set of December economic data points that will provide important signposts for both the state of the economy in advance of a year of potential Central Bank policy tightening, and on how big of an impact the Omicron variant of Covid-19 has had on the global economy.

All times listed are EST

Tuesday

10:00: US – ISM Manufacturing PMI: to edge lower to 60.4 from 61.1.

10:00: US – JOLTs Job Openings: previously printed at 11.033M.

Wednesday

8:15: US – ADP Nonfarm Employment Change: seen to have fallen to 413K from 534K in December.

Tentative: US – FOMC Meeting Minutes

Thursday

8:30: US – Initial Jobless Claims: to jump to 208K from 198K.

10:00: US – ISM Non-Manufacturing PMI: predicted to drop to 66.8 from 69.1.

Friday

8:30: US – Nonfarm Payrolls: seen to jump to 400K from 210K.

8:30: US – Unemployment Rate: to fall to 4.1% from 4.2%.

Top 3 Leading and Lagging Sectors (Weekly)

1. $XLRE (Real Estate) +3.79%

2. $XLU (Utilities) +2.67%

3. $XLB (Materials) +2.60%

Benchmark: $SPY +0.93%

1. $XLC (Communication Services) -0.55%

2. $XLK (Technology) +0.54%

3. $XLF (Financial) +0.59%

Market Breath (Weekly)

% of Stocks Above 200 DMA = 45.78% (+6.66%)

% of Stocks Above 50 DMA = 41.88% (+12.04%)

Market Technicals (Rally Cycle Count: Day 9 of 25)

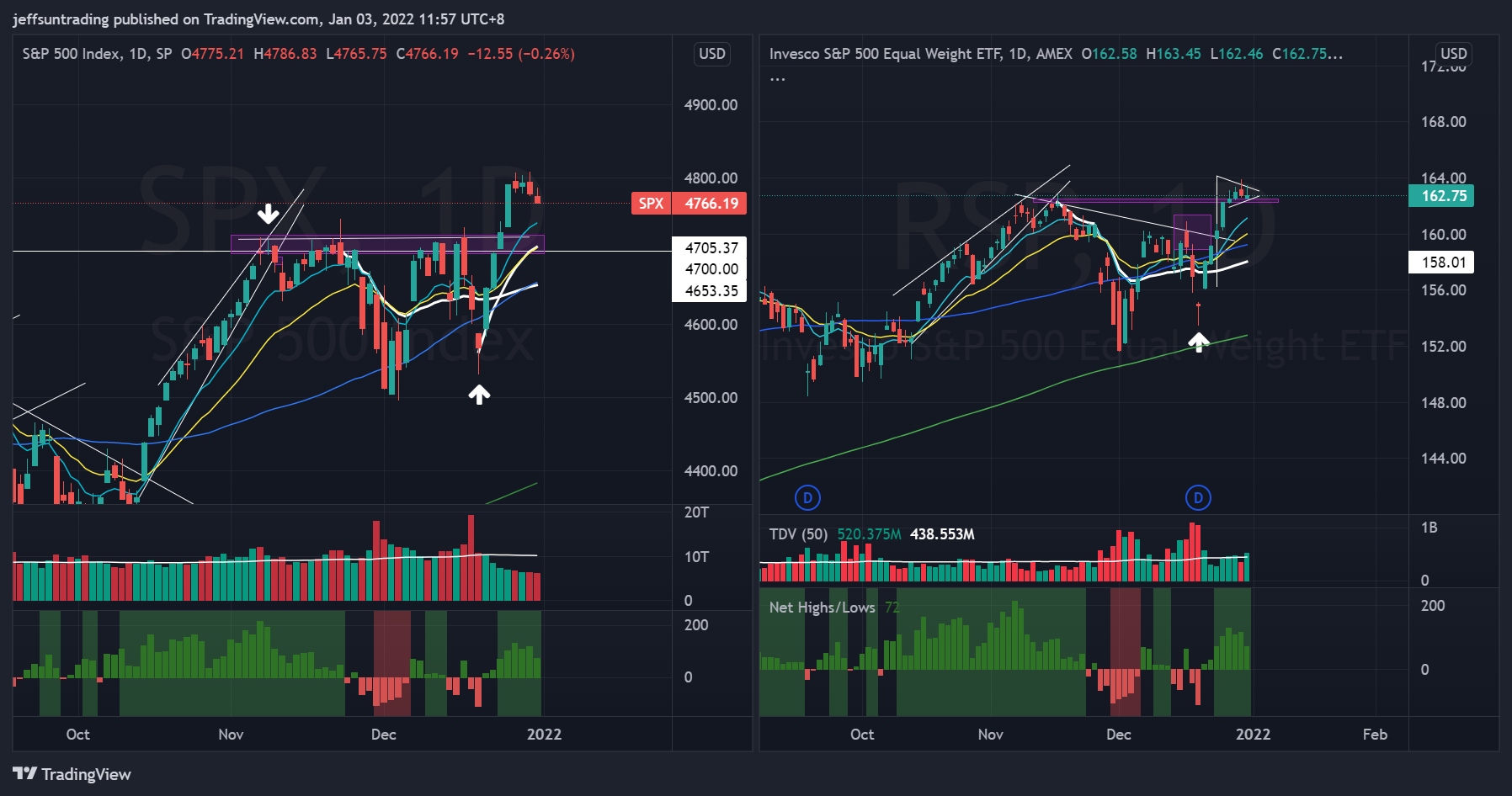

$SPX (S&P 500) vs $RSP (S&P 500 Equal Weight) – (Net High/Low +72)

$SPX furthered its strength with a gain of +0.86% (+40.41 points), breaking out of its all time high resistance level that is had been key over the past two months (tested four times over the past 8 weeks).

At the current juncture, both $SPX and $RSP is exhibiting a bullish flag formation price action behavior, setting up for a potential new leg to a fresh new all time high within the week or next.

The immediate support to watch for $SPX this week is at 4,700 level, a prior resistance turned support and VWAP support level.

$QQQ (Nasdaq 100) vs $QQQE (Nasdaq 100 Equal Weight)

The disparity between $QQQ (-0.23%) vs $QQQE (+0.53%) minimised over the week, with the leading $QQQ closing negative and laggard $QQQE closing on positive note. It is also the first time $QQQE have closed above the 10D and 20D Moving Averages since Mid-November 2021.

$QQQ is currently 2.63% off its high, and $QQQE is 5.54% off its high. Both indexes also exhibited similar bullish flag pattern as $SPX and $RSP.

The support level to watch for $QQQE remains at $84.7 AVWAP level. Holding off the aforementioned level will ascertain the sustainability of the rally in $QQQ.

$PCCE (Put/Call Ratio Equity) & $VIX (Volatility S&P 500)

The spike level to watch for $PCCE is at 1.00, where the current reading of 0.642 (+0.09%) reflects momentum in the current rally.

$VIX reading similarly declined further to 17.21 (-4.12%) from 17.95 also confirming the rally we are experiencing over the past week.

$IEI/HYG (Credit Spread) – $TNX (10YR Treasury Yield)

Credit Spread remains at 1.48% over the week during which $TNX creeped up to 1.511% (+1.27%). The low spread level remains ascertain of the sustainability of the existing market rally.

Trading Ideas

$HTZ building up a 8 weeks base with a double bottom pattern, chopping around its 50MA. similar occurrence happened in September before staging a +105% rally in a month.#Tradingview #swingtrade #SwingTrading pic.twitter.com/Q5JJwhl7Sq

— Jeff Sun, CFTe (@jeffsuntrading) January 3, 2022

$PRTA late stage biotech firm. have higher low tightening price action since mid dec, closing above 10/20 and 200MA for the first time after a ATH peak to trough correction of -38% 3 months ago.

lucrative risk reward if this trades work#swingtrade #SwingTrading #Tradingview pic.twitter.com/ssVqPAEwfg

— Jeff Sun, CFTe (@jeffsuntrading) January 1, 2022

$WFRD microcap but when they setup, it wouldn’t take too long for them to start their next leg. 52 week VWAP coincide with 50MA, definitely the price level to watch#SwingTrading #TradingView #swingtrade pic.twitter.com/0sgOCfNZxp

— Jeff Sun, CFTe (@jeffsuntrading) December 31, 2021

Do follow me on twitter for more daily trading ideas.