The Market staged a strong rebound last week, initially selling off on a worsening Russia-Ukraine situation, then rallying on optimism that the situation won’t have a material impact on the economy. The S&P 500 ended with a +0.8% gain after being down as much as -5.4% during the week.

A decision on Saturday by Western nations to block some Russian banks from the SWIFT international payments network as punishment for the invasion of Ukraine looks set to trigger a fresh wave of volatility when markets open on Monday.

Testimony from Federal Reserve Chair Jerome Powell may give investors an indication of how the war in Ukraine and rising energy prices have impacted the monetary policy outlook.

On the economic calendar, Friday’s U.S. employment report for February is expected to show the recovery in the labor market remains solid.

Here’s what you need to know to start your week.

1. Russia SWIFT ban

Western allies announced sweeping new sanctions against Moscow on Saturday, including blocking some banks from the SWIFT international payments system. The decision will be implemented in the coming days.

The allies, who also vowed curbs on the Russian central bank to limit its ability to support the ruble, have not yet said which banks would be targeted, but a European Union diplomat said some 70% of the Russian banking market would be affected.

Investors have been fearful about moves to block Russian banks from SWIFT as this would disrupt global trade and hurt Western interests, as well as hit Russia.

2. Powell testimony

With sanctions against Russia escalating and market volatility remaining at elevated levels, testimony on the economy and monetary policy by Fed Chair Jerome Powell this week will need to reassure investors that the Fed will take steps to tackle soaring inflation as the economic outlook grows more uncertain.

Powell is due to testify before the House Committee on Financial Services on Wednesday, and again before the Senate Banking Committee on Thursday.

The Fed has indicated that it is poised for an interest rate lift-off at its upcoming March meeting, to combat inflation which is running at a 40-year high. But now Fed officials must weigh the geopolitical and economic fallout from the conflict in Ukraine against mounting an aggressive attempt to curb inflation.

Russia’s invasion of Ukraine will fuel a sharper increase in the cost of living by driving up energy prices, while the extra squeeze on household spending is likely to act as a drag on the economic recovery, which has already been hit by the Omicron wave.

3. Commodity prices

Russia’s invasion of Ukraine sent oil prices above $100 a barrel for the first time since 2014 on Thursday with Brent touching $105, before paring gains. European gas prices have also surged amid concerns over supply security.

Russia is the world’s second-largest crude producer and a major natural gas provider to Europe.

Energy traders will be awaiting details on the moves to block Russian banks from SWIFT to see if the sanctions will impact oil and gas flows, but the measures will likely discourage many buyers from purchasing Russian oil.

Meanwhile, ministers from the Organization of the Petroleum Exporting Countries (OPEC) and allies led by Russia, a grouping known as OPEC+, are to meet on Wednesday to decide whether to increase output by 400,000 bpd in April.

Key Economic Calendar (Weekly)

Friday’s nonfarm payrolls report for February is expected to reflect the economy added 450,000 jobs with the unemployment rate expected to tick down to 3.9% and average hourly earnings forecast to rise at a 5.8% annual rate.

Ahead of the employment report, payrolls processor ADP is due to release figures on private sector hiring on Wednesday and the Labor Department is to publish the weekly report on initial jobless claims on Thursday.

The economic calendar also features surveys of the manufacturing and service sectors for February by the Institute of Supply Management (ISM), which are likely to have rebounded as the impact of the Omicron wave on business activity subsided.

All times listed are EST

Tuesday

10:00: US – ISM Manufacturing PMI: expected to edge higher to 58.0 from 57.6.

Wednesday

8:15: US – ADP Nonfarm Employment Change: likely to surge to 350K from -301K.

Thursday

10:00: US – Fed Chair Jerome Powell Testifies before Congress.

10:00: US – ISM Non-Manufacturing PMI: anticipated to edge up to 61.0 from 59.9.

Friday

8:30: US – Nonfarm Payrolls: predicted to ease to 450K from 467K.

8:30: US – Unemployment Rate: seen to decline to 3.9% from 4.0%.

Top 3 Leading and Lagging Sectors (Weekly)

8 of the 11 S&P 500 sectors closed higher, paced by real estate (+2.18%), healthcare (+1.93%) and utilities (+1.87%) sectors. The consumer discretionary (-2.72%), financials (-0.33%) and industrial (-0.03%) sectors closed lower.

1. $XLRE (Real Estate) +2.18%

2. $XLV (Healthcare) +1.93%

3. $XLU (Utilities) +1.87%

Benchmark: $SPY +0.16%

1. $XLY (Consumer Discretionary) -2.72%

2. $XLF (Financial) -0.33%

3. $XLI (Industrial) -0.03%

Market Breath (Weekly)

% of Stocks Above 200 DMA = 35.64% (+3.94%)

% of Stocks Above 50 DMA = 38.70% (+8.89%)

Market Technicals – (S&P 500, NASDAQ, Bitcoin, Bonds & Credit Spread, NAAIM)

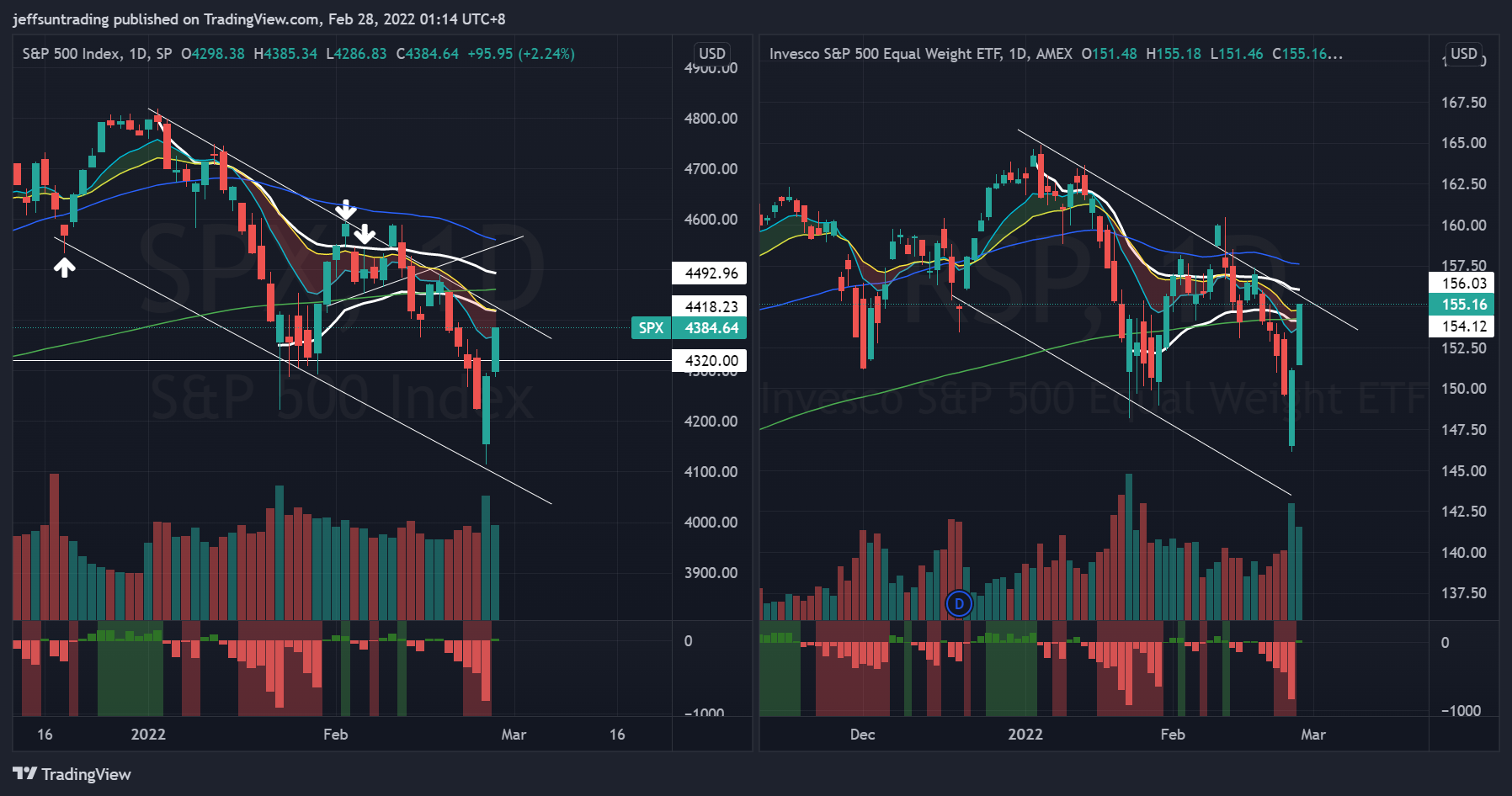

$SPX (S&P 500) vs $RSP (S&P 500 Equal Weight) – (Net High/Low +24)

The S&P 500 ($SPX) ended with a +0.82% gain after being dragged down as much as -5.4% during the week.

Improved posture in weekly market breath continue to be observed for the second week in running;

- % of Stocks Above 200 DMA = 35.64% (+3.94%)

- % of Stocks Above 50 DMA = 38.70% (+8.89%)

$SPX remains resisted by a Downtrend Line, along with its 200-day moving average. A downtrend channel in $SPX have also been established during the week, after breaching 4,320 level for the formation of a lower low.

The immediate support to watch for $SPX this week remains at a re-test of 4,320 level.

$QQQ (Nasdaq 100) vs $QQQE (Nasdaq 100 Equal Weight) – Downtrend Channel In Play

Tech and growth names have been hard hit since the start of 2022 by a rapid rise in Treasury yields on the back of expectations that the Fed will hike interest rates aggressively to combat high inflation as higher rates can hurt their companies with high valuations based on the prospect of future profits.

$QQQ gained +1.25% with $QQQE also gaining +1.63% during the week. Similar to $SPX, $QQQ have also established a downtrend channel.

The support level to watch for $QQQ remains at a re-test of $340.

$BTCUSD (Bitcoin / USD) – Morphing out a Bearish Head and Shoulder Pattern

Bitcoin ($BTCUSD) subdued its previous week sell off, posting a modest gain of +1.80% over the week. At the current juncture, $BTCUSD remains resisted below the convergence of declining moving averages (10, 20 and 50 day), along with its anchored VWAP from 27th December high.

$BTCUSD continues to be morphing out a right side shoulder of a mid-term bearish Head and Shoulder Pattern.

The next level of support to watch for $BTCUSD remains at a re-test of $37,000.

$PCCE (Put/Call Ratio Equity) & $VIX (Volatility S&P 500) – VIX remains at worrying level

The spike level to watch for $PCCE is at 1.00. The the current reading of 0.819 (-21.76%) temporarily reduced the pressure on risk sentiment of the market.

However, $VIX remains at a high level of 27.57 (-0.61%), implying risk of a further sell off.

$IEI/$HYG (Credit Spread) – $TNX (10YR Treasury Yield) – Eyes on Spread

Market participants are keeping a close watch on credit spreads as one of the better economic signals. Junk bond issuers are perceived to be bigger credit risks, so if economic growth slows or contracts, there will be increased angst that these issuers won’t be able to make good on their interest payments. Hence, a widening high-yield spread is regarded as a leading indicator of difficult economic times which, in turn, often invites a more challenging period for the stock market since difficult economic times translate into weaker earnings prospects.

Credit Spread lowered to 1.50% over the week (-0.01). On the flipside, $TNX have inched up to 1.985% (+0.054) just slightly off its 52-weeks high of 2.046% established on 16th February 2022.

NAAIM Exposure Index – 44.41 (-9.08)

The NAAIM Exposure Index represents the average exposure to US Equity markets reported by members of the National Association of Active Investment Managers. It provides insight into the actual adjustments active risk managers have made to client accounts over the past two weeks.

This week’s NAAIM Exposure Index number is: 44.41, down from 53.

Top Trading Ideas for the Week

$CLFD bullish pennant pattern. +35% move (3 weeks) since Q4 ER. ER reflected YoY accelerated growth in both EPS and Rev.

looking at BO from Q3 ER AVWAP resistance at $64.70.

Q4’21 Earnings (YoY)

EPS 0.75 (+226%)

Sales 51.1M (+89%) pic.twitter.com/nyWMYaqCoj— Jeff Sun, CFTe (IFTA) (@jeffsuntrading) February 22, 2022

$AR O&G exploration name. weekly chart reflects a clean inverse H&S. this is the textbook classic trend reversal pattern chart.

though RS low was established in dec, price action was widely volatile on its way up. ATR % at 5.68% of price

BO entry will require a wider stop pic.twitter.com/QDScIG61QV

— Jeff Sun, CFTe (IFTA) (@jeffsuntrading) February 22, 2022

$MLI metals manufacturer. RS already cleared its 52 wks high, while price remain resisted below a 3mths DTL.

price have been riding on its rising 10MA since Q4 earnings. convergence of shorter MA with 50d

it gained +39% in less than a month (oct’21) during the last DTL breakout pic.twitter.com/kEcem4sodr

— Jeff Sun, CFTe (IFTA) (@jeffsuntrading) February 22, 2022

Do follow me on twitter for more daily trading ideas.