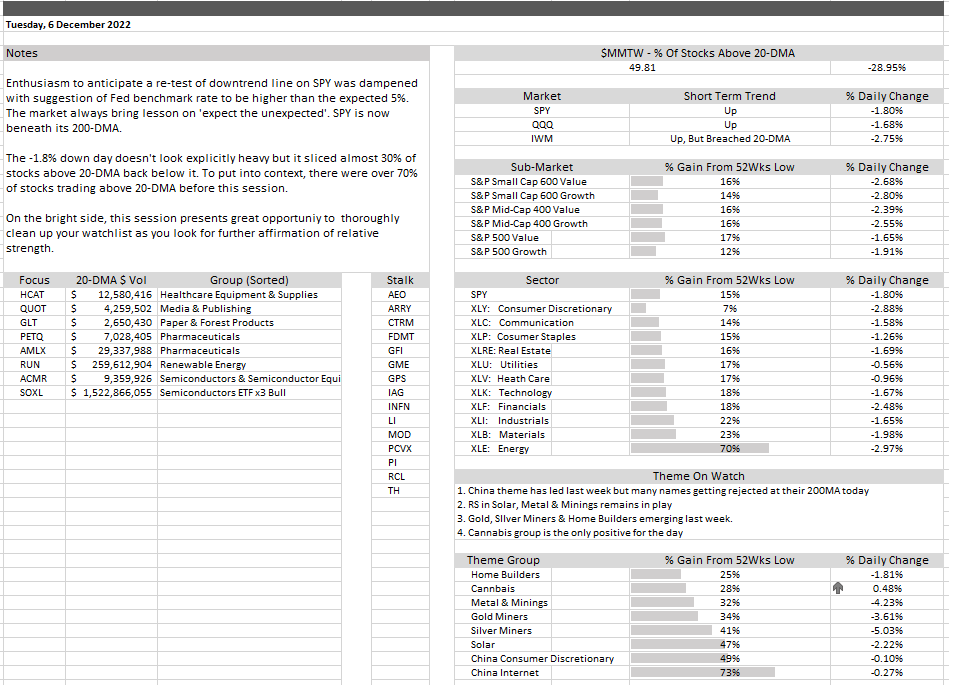

Enthusiasm to anticipate a re-test of downtrend line on SPY was dampened with suggestion of Fed benchmark rate to be higher than the expected 5%.

The market always bring lesson on ‘expect the unexpected’. SPY is now beneath its 200-DMA.

The -1.8% down day doesn’t look explicitly heavy but it sliced almost 30% of stocks above 20-DMA back below it. To put into context, there were over 70% of stocks trading above 20-DMA before this session.

On the bright side, this session presents great opportunity to thoroughly clean up your watchlist as you look for further affirmation of relative strength.

Thanks for reading.

PS: Follow me on twitter (@jeffsuntrading) to get further daily pre-market diary, trading ideas and market updates.