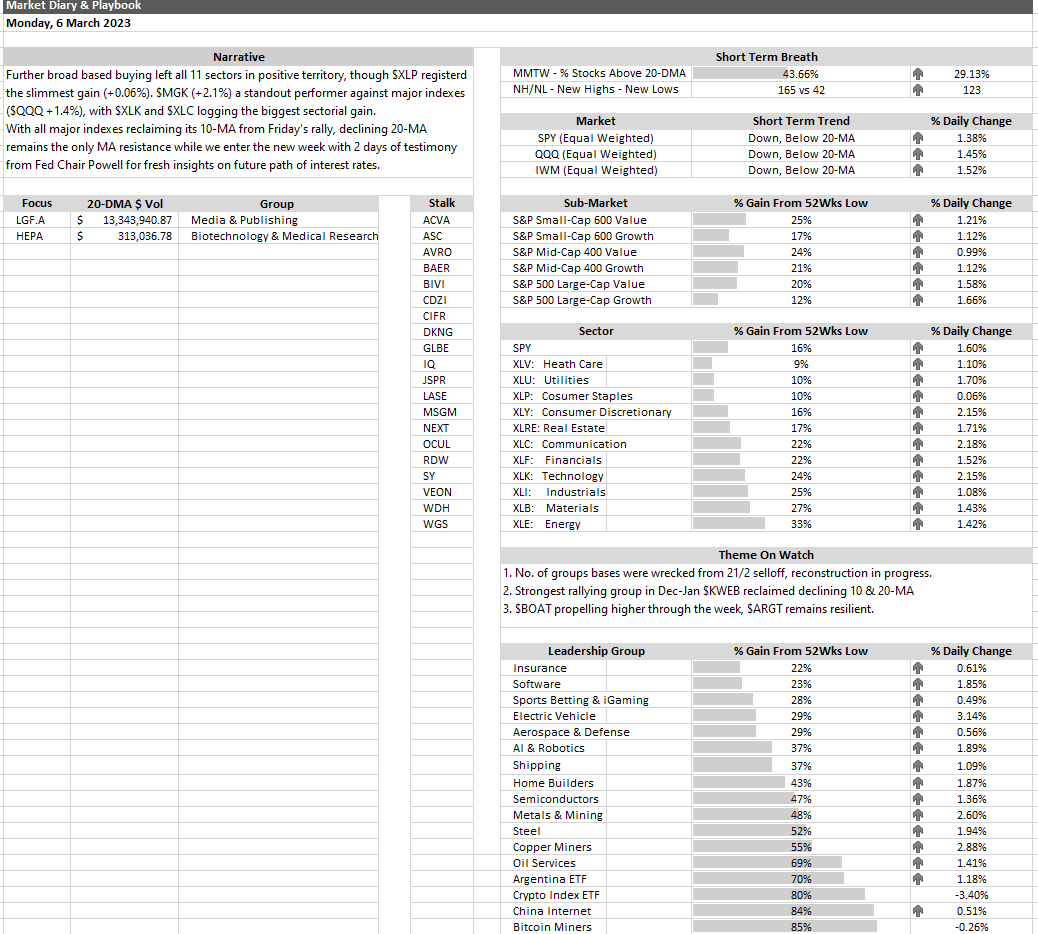

Further broad based buying left all 11 sectors in positive territory, though $XLP registerd the slimmest gain (+0.06%). $MGK (+2.1%) a standout performer against major indexes ($QQQ +1.4%), with $XLK and $XLC logging the biggest sectorial gain.

With all major indexes reclaiming its 10-MA from Friday’s rally, declining 20-MA remains the only MA resistance while we enter the new week with 2 days of testimony from Fed Chair Powell for fresh insights on future path of interest rates.

Thanks for reading.

PS: If you enjoy the above curated article, you may follow me on twitter (@jeffsuntrading) to get daily market diary, trading ideas and market updates.

6/3/2023 Market Diary

-Broad based rally, all sectors +ve though $XLP registered slim gain (+0.06%)

– $MGK (+2.1%) standout against major indexes ie. $QQQ, $XLK & $XLC logged largest sectorial gain

-Fresh insights for rates in 2days of testimony frm Fed Chair ahead

Read more pic.twitter.com/kh1GtS1ALq

— Jeff Sun, CFTe (@jeffsuntrading) March 6, 2023