Started the first week of February with market further thrusted by setting a new high for the year, and NH/NL continues to print strong underlying data alongside $MMTW. $SPY hit a year to date high on 2nd February as $META led the market with a +23% day gain after beating its revenue estimates for Q4’23. Spillover effect on $XLC +6.6% surge for that day creates wholesome of euphoria to take test position into $IGVand $SOCL industry group names.

Consolidation from first pullback in the market took place from 3rd to 16th feb before first undercutting key moving averages 20-MA. Only managed to brake and slowdown on my trading rhythm by then. Could have been a whole lot worse for the month if i did not cut down my trade frequency from 110 (January) to 69 (this month). 5 key trades (namely $ASRT, $BORR, $TMV, $DBD, $IREN) make up to almost 23 losing trades.

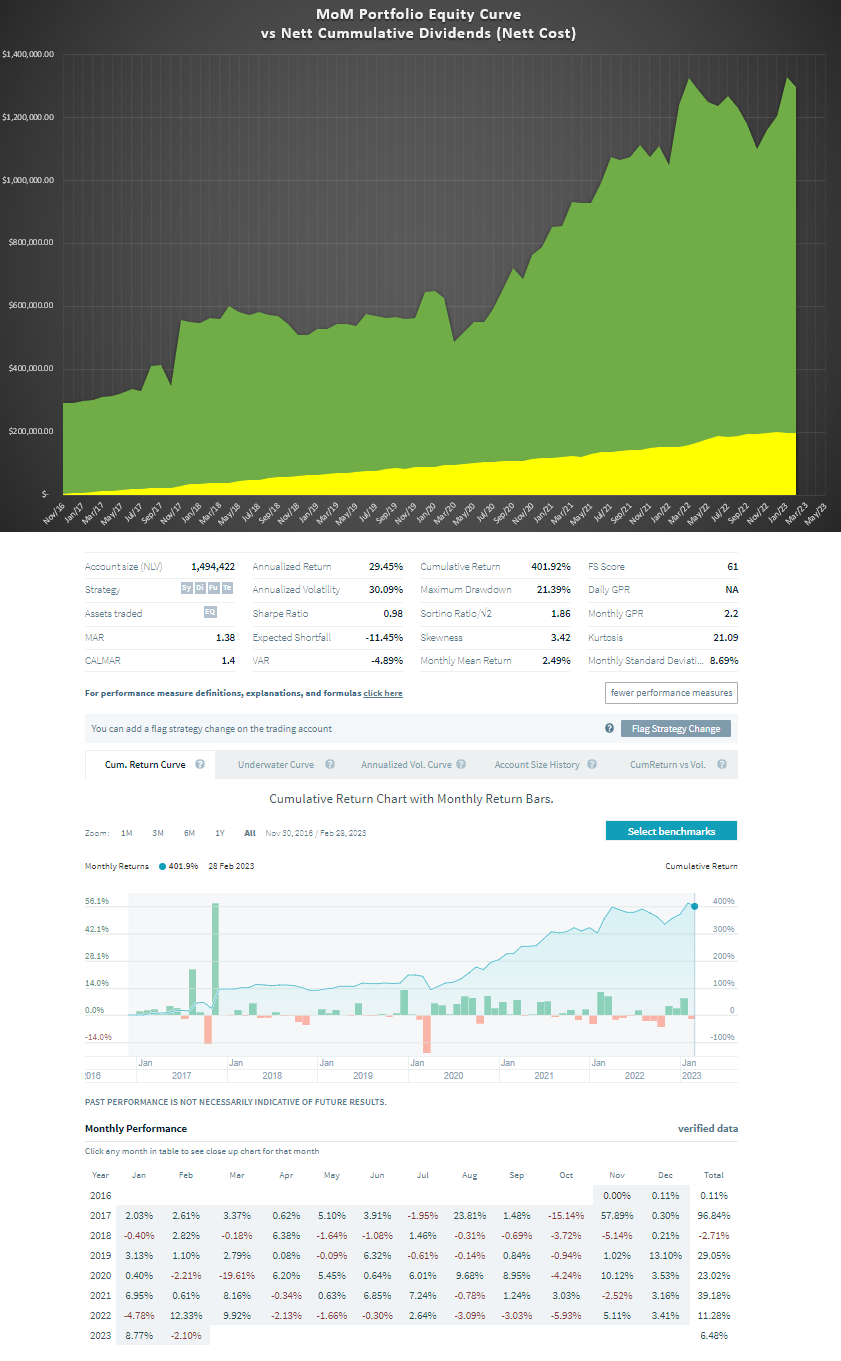

February 2023 (Month #76)

Total Trades: 69 (Month)

Month Absolute Gain (Loss): -$32,127.33

Month Nett Cost After Dividends: -$36.11

Month Return: -2.10%

Month % R (Fractional Kelly C): 0.25%

Month Win Rate: 14.21%

Cumulative Return: +401.92% (Annualized: +29.45%)

Thanks for reading.

PS: If you wish to keep track of my daily trading playbook and diary, you may follow me on twitter (@jeffsuntrading) to get my trading ideas, thought processes and key market updates.