While the market concluded the week on a strong note on all front, ironically stock selection can become increasingly challenging because pullbacks always seem imminent. Opening new positions on stocks that are emerging from long-term bases in the upcoming weeks can be considered as trading on severely lagging stocks, particularly when the market continues to distance itself from its moving averages, resembling an expanded rubber band.

It may be more prudent to prioritize stocks that have already clinched their YTD highs as early as May and have experienced slight pullbacks to their 10/20 moving averages for past weeks.

Thanks for reading.

PS: If you enjoy the above curated article, you may follow me on twitter (@jfsrevg) to get daily market diary, trading ideas and intermittent reflection on life as a trader.

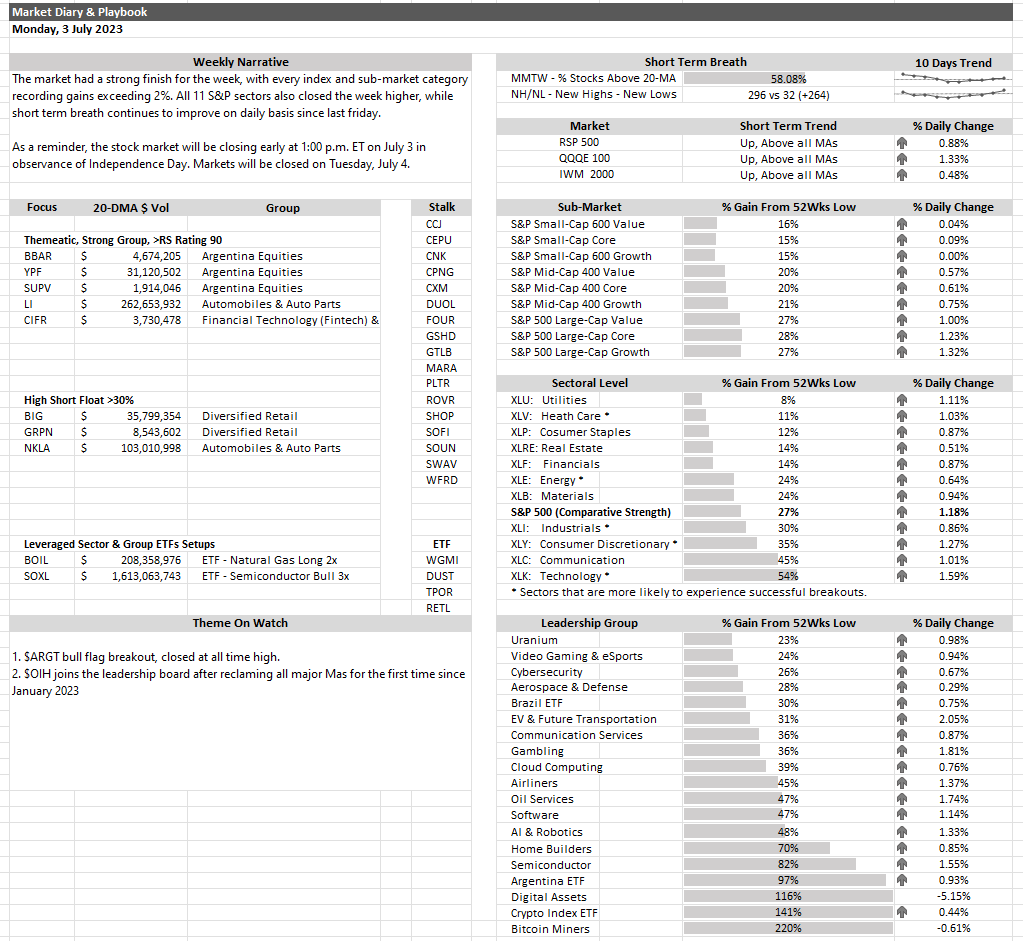

Week of 3/7/2023 Market Diary,

While the market concluded the week on a strong note on all front, ironically stock selection can become increasingly challenging because pullbacks always seem imminent. Opening new positions on stocks that are emerging from long-term bases in the… pic.twitter.com/YKOX0czkHK

— Jeff Sun, CFTe (@jfsrevg) July 2, 2023