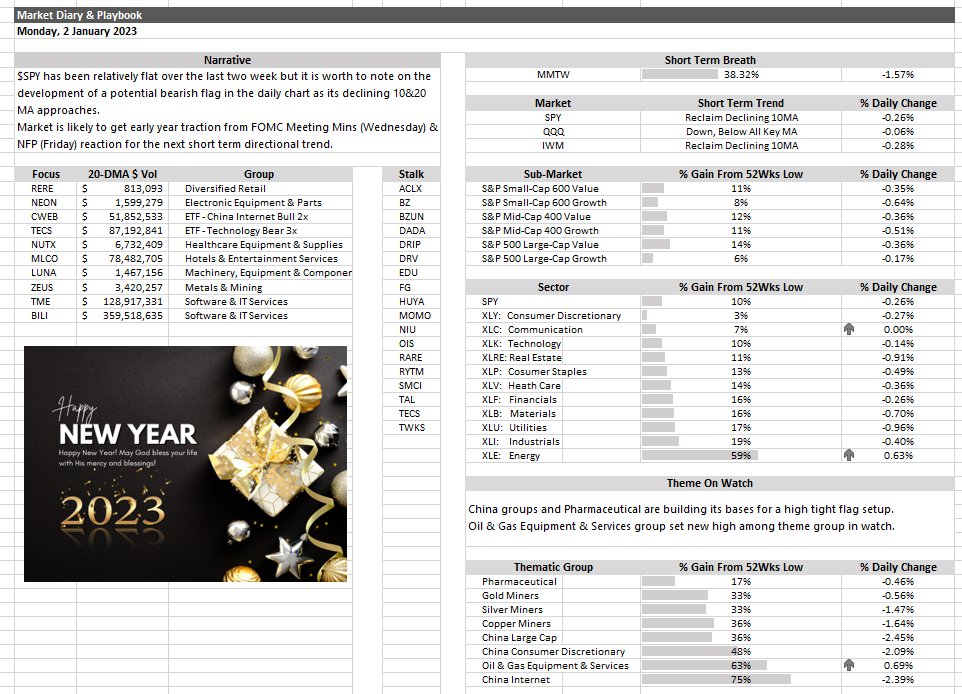

$SPY has been relatively flat over the last two week but it is worth to note on the development of a potential bearish flag in the daily chart as its declining 10&20 MA approaches.

Market is likely to get early year traction from FOMC Meeting Mins (Wednesday) & NFP (Friday) reaction for the next short term directional trend.

Thanks for reading.

PS: If you enjoy the above curated article, you may follow me on twitter (@jeffsuntrading) to get daily market diary, trading ideas and market updates.

2/1/2023 Market Diary & Playbook

– $SPY (-0.26%) net highs/lows -9, remaining relatively flat after 2 weeks of trading (-0.3%)

– $SPY morphing out a bear flag as declining MA approaches

– early year traction likely from FOMC (Wed) & NFP (Fri) reaction for next short term trend pic.twitter.com/yahvmV9UBD— Jeff Sun, CFTe (@jeffsuntrading) January 2, 2023