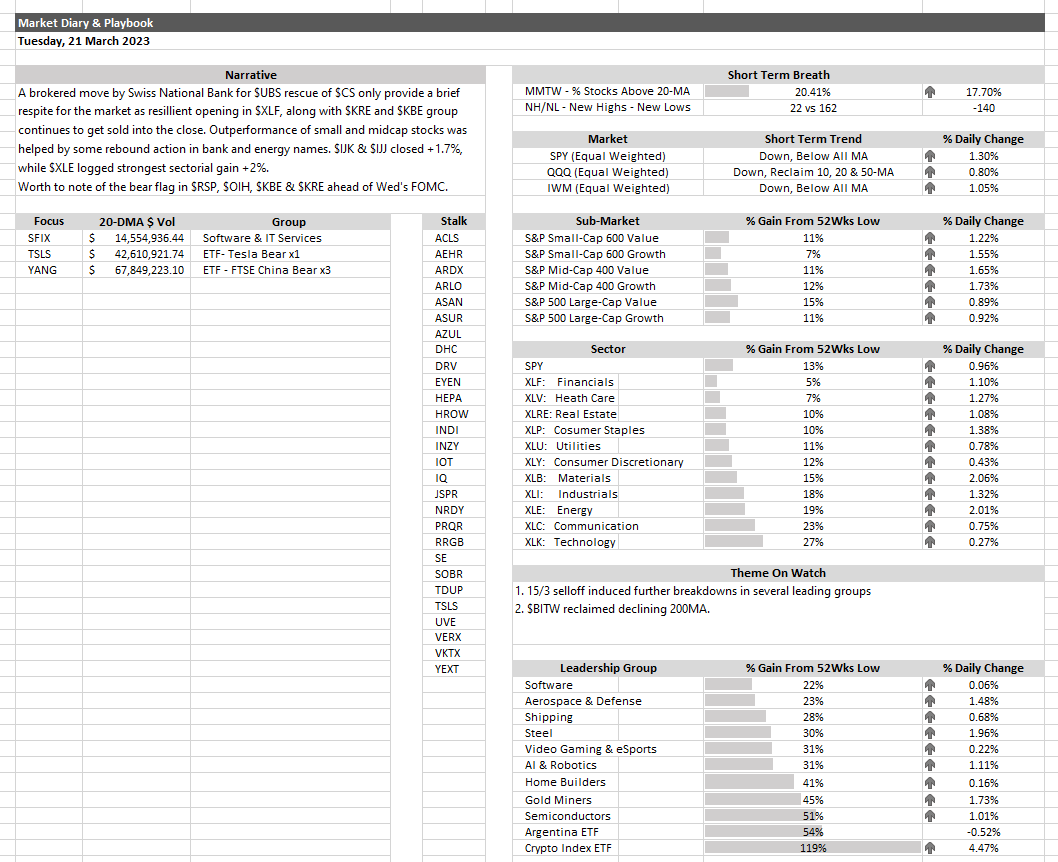

A brokered move by Swiss National Bank for $UBS rescue of $CS only provide a brief respite for the market as resillient opening in $XLF, along with $KRE and $KBE group continues to get sold into the close. Outperformance of small and midcap stocks was helped by some rebound action in bank and energy names. $IJK & $IJK closed +1.7%, while $XLE logged strongest sectorial gain +2%.

Worth to note of the bear flag in $RSP, $OIH, $KBE & $KRE ahead of Wed’s FOMC.

Thanks for reading.

PS: If you enjoy the above curated article, you may follow me on twitter (@jeffsuntrading) to get daily market diary, trading ideas and market updates.

21/3/2023 Market Diary

-Brokered move by Swiss National Bank for $UBS rescue of $CS only provide brief respite

-Resilient opening in $XLF $KRE $KBE continues to get sold into close

– $IJJ $IJK +1.7%, $XLE logged strongest sector gain +2%

Read more pic.twitter.com/etJ4oir3Oj

— Jeff Sun, CFTe (@jeffsuntrading) March 21, 2023