The S&P 500 fell 2.9% over the week after the oil prices flirted with $130 per barrel with anticipation of U.S. ban on Russian energy imports. Nasdaq Composite and Russell 2000 both fell 3.5% and 1.1% respectively.

With oil up 45% for the year and total CPI up 7.9% year-over-year in February, the current inflationary environment fueled concerns about a slowdown in consumer spending and expectations for the Fed to hike rates more aggressively this year. The Federal Reserve is widely expected to announce its first interest rate hike since 2018 on Wednesday.

The massive rally in commodities looks set to continue, while stocks continue to struggle.

Here’s what you need to know to start your week.

1. Fed rate hike

The Fed has clearly signaled that it intends to deliver a quarter-point interest rate hike after its two-day policy meeting concludes on Wednesday, to combat soaring inflation, which at 7.9% is far above the Fed’s 2% target.

A larger half percentage point rate hike is no longer on the cards since Russia’s invasion of Ukraine sent commodity prices soaring and triggered major uncertainty in financial markets.

Massive rallies in commodities have added to pressure on global central banks to tighten monetary policy and curb inflation. But this has sparked concerns that higher interest rates will act as a drag on economic growth at a time when price increases are already weighing on consumers.

The Fed will be releasing its updated ‘dot plot’ which tracks projections for interest rates, with investors keen to see how the war is affecting the monetary policy outlook. Investors will also be on the lookout for any guidance on plans for the central bank’s almost $9 trillion balance sheet.

2. Commodity rally

The recent massive rally in commodity prices could potentially be set to continue for an extended period with a quick resolution to the war in Ukraine in doubt.

The war and ensuing sanctions on Russia sent oil prices to 14-year highs and natural gas prices near records. Prices for wheat and copper stand near all-time highs, while a doubling of the price of nickel last week forced the London Metals Exchange to halt trading in the metal.

U.S. government officials have called on domestic and global producers to ramp up oil output to offset the supply shock and there is talk around potential supply additions from Iran, Venezuela, and the United Arab Emirates.

Key Economic Calendar (Weekly)

All times listed are EST

Tuesday

8:30: US – PPI: to slip to 0.9% from 1.0%.

Wednesday

8:30: US – Core Retail Sales: forecast to plunge to 1.0% from 3.3%.

8:30: US – Retail Sales: anticipated to plummet to 0.4% from 3.8%.

14:00: US – FOMC Economic Projections, Statement, Interest Rate Decision: forecast to rise 25 basis points to 0.5%

14:30: US – FOMC Press Conference

Top 3 Leading and Lagging Sectors (Weekly)

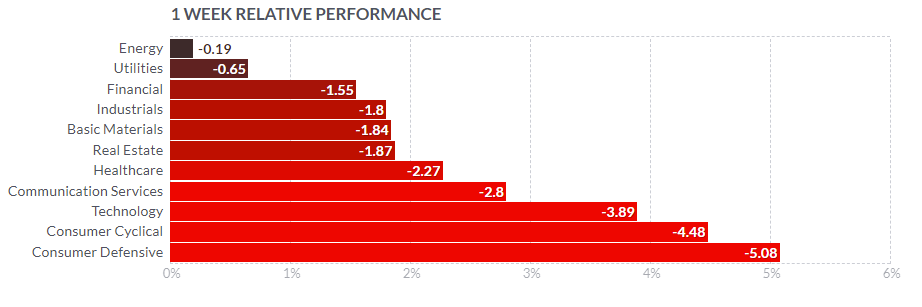

All eleven sectors in the S&P 500 sectors ended in negative territory. The consumer staples (-5.08%), consumer cyclicals (-4.48%) and information technology (-3.89%) sectors were the weakest performers.

Market Breath (Weekly)

% of Stocks Above 200 DMA = 31.84% (-5.41%)

% of Stocks Above 50 DMA = 33.13% (-3.89%)

Market Technicals – (S&P 500, NASDAQ, Bitcoin, Bonds & Credit Spread, NAAIM)

$SPX (S&P 500) vs $RSP (S&P 500 Equal Weight) – (Net High/Low -180)

The S&P 500 ($SPX) deepens its weekly loss with a further -2.88% decline, notches its second straight week of losses while the Dow Jones Industrials ($DJI) fell for a fifth straight week as Russia-Ukraine war drags on.

Stocks have struggled this year as concerns about the Russia-Ukraine crisis have deepened a sell-off initially fueled by worries over higher bond yields with the Fed on course to tighten monetary policy. The S&P 500 is down 11.8% so far in 2022.

$SPX remains trapped beneath its Downtrend Line, with further rejection observed to its declining 20-day moving average (5th attempt).

The immediate support to watch for $SPX this week is at 4,150 level, a 10 months low support that was reclaimed intraday some three weeks ago.

$QQQ (Nasdaq 100) vs $QQQE (Nasdaq 100 Equal Weight) – Downtrend Channel In Play

Tech and growth names have been hard hit since the start of 2022 by a rapid rise in Treasury yields on the back of expectations that the Fed will hike interest rates aggressively to combat high inflation as higher rates can hurt their companies with high valuations based on the prospect of future profits.

Similar to $SPX, $QQQ fell -3.82% during the week. The support level to watch for $QQQ this week remains at $319.

$BTCUSD (Bitcoin / USD) – Morphing out a Bearish Head and Shoulder Pattern

Bitcoin ($BTCUSD) ended the week with a further gain of +0.99%. At the current juncture, $BTCUSD remains trading below the convergence of declining moving averages (10, 20 and 50 day), along with its anchored VWAP from 27th December high.

$BTCUSD continues to be morphing out a right side shoulder of a mid-term bearish Head and Shoulder Pattern.

The next level of support to watch for $BTCUSD remains at a re-test of $37,000.

$PCCE (Put/Call Ratio Equity) & $VIX (Volatility S&P 500) – $PCCE Uptrend Since January

The spike level to watch for $PCCE is at 1.00. The the current reading of 0.863 (+4.16%) reflects pressure on risk sentiment of the market. $PCCE has been on short term uptrend since the start of 2022.

On the contradictory, $VIX have eased off from its peak of 36.44, to 30.74 (-3.85%). However, this level still implies a risk off sentiment for market participants.

$IEI/$HYG (Credit Spread) – $TNX (10YR Treasury Yield) – Eyes on Spread

Market participants are keeping a close watch on credit spreads as one of the better economic signals. Junk bond issuers are perceived to be bigger credit risks, so if economic growth slows or contracts, there will be increased angst that these issuers won’t be able to make good on their interest payments. Hence, a widening high-yield spread is regarded as a leading indicator of difficult economic times which, in turn, often invites a more challenging period for the stock market since difficult economic times translate into weaker earnings prospects.

Credit Spread rise to 1.54% over the week (+0.01). $TNX have risen sharply to 2.003% (+0.278).

NAAIM Exposure Index 42.58 (+12.28)

The NAAIM Exposure Index represents the average exposure to US Equity markets reported by members of the National Association of Active Investment Managers. It provides insight into the actual adjustments active risk managers have made to client accounts over the past two weeks.

This week’s NAAIM Exposure Index number is: 42.58 up from 30.30.

Top Trading Ideas for the Week

$SG took out its DTL after a series of lower highs beneath its AVWAP from IPO. this is the first sign of strength.

last 2 days price action closed above this VWAP lvl (2nd time since 27th dec), with 10/20 MA bullish crossover.

key lvl remains $36.40. also a saucer base BO level pic.twitter.com/n5MTpY5iOu

— Jeff Sun (@jeffsuntrading) March 11, 2022

$CARG bouncing off its VWAP from Q3 ER to rising 10&20MA. it underwent 6 consecutive days of low volume retracement after rallying +43.96% post Q4 ER to fantastic YoY growth numbers (EPS +34%, Sales +124%)

the last significant VWAP to reclaim is from Q4 ER at $43.05 pic.twitter.com/qjQ0WrzOaW

— Jeff Sun (@jeffsuntrading) March 11, 2022

$DDS grinded out a new RS high for 2022, continues to be held between two key VWAP area with coiling action in KMA.

With $ES already up +2% pre-market, $DDS will be poised for a breakout of its $277 pivot, maintaining its strong RS posture. pic.twitter.com/X3gzOUssBH

— Jeff Sun (@jeffsuntrading) March 9, 2022

Do follow me on twitter for more daily trading ideas.