US stocks closed Monday’s session mostly down, as concerns about rising commodity prices, and slower economic growth have undercut the market. The Russia-Ukraine situation has exacerbated those concerns along with the understanding that the Federal Reserve is going to move soon to raise interest rates.

The war in Ukraine will continue to dominate market sentiment this week. U.S. CPI numbers for February will be closely watched ahead of a looming rate hike by the Federal Reserve on March 16.

Here’s what you need to know to start your week.

1. Market turbulence, Commodity rally

Geopolitical worries will continue to cloud the outlook for U.S. equities, even as concerns over soaring inflation and higher commodity prices, stoked by sanctions against Russia, curb expectations for how aggressively the Fed will hike rates.

Soaring commodity prices have raised fears of even greater inflation, which could prompt the Fed to hike interest rates more aggressively.

Oil prices posted their largest weekly gains since mid-2020 last week, with the Brent benchmark up 21% and U.S. crude gaining 26% as the Biden administration is looking at cutting imports of Russian oil, with a fast-tracked bill that would ban Russian energy imports entirely.

Delays to the conclusion of talks on Iran’s nuclear deal could also push oil prices higher in the coming week.

Besides oil, prices of grains and metals have also soared to multi-year highs since Russia’s invasion of Ukraine as Western sanctions on Moscow disrupted exports from major producer Russia and threatened a growing global supply crunch.

2. U.S. CPI

Data on Thursday is expected to show U.S. inflation surged again last month, with economists forecasting an increase of 7.9% year-on-year, after January’s four-decade high of 7.5%.

With the US already facing the highest inflation in over four decades, triggered by COVID lockdowns and restrictions, and the February CPI release this week anticipated to show an escalation during the previous month, the real possibility of an economic recession looms even larger.

Fed Chair Jerome Powell said previously he would support a 25-basis-point interest rate increase at the central bank’s upcoming meeting next week but added that he would be prepared to move more aggressively later if inflation does not subside as quickly as expected.

Key Economic Calendar (Weekly)

All times listed are EST

Top 3 Leading and Lagging Sectors (Weekly)

The stock market was afflicted by a 25% pop in oil prices, which were driven by worsening developments surrounding Russia’s invasion of Ukraine. 5 of the 11 S&P 500 sectors closed higher. Energy sector benefited from the surge in oil prices (+9.2%). The utilities (+4.9%), real estate (+1.7%), and health care (+1.2%) sectors also closed higher amid some defensive positioning.

The biggest laggards were found in the financials (-4.8%), technology (-3.0%), communication services (-3.0%), and consumer discretionary (-2.6%) sectors, which dropped between 2-5%.

1. $XLE (Energy) +9.22%

2. $XLU (Utilities) +4.90%

3. $XLRE (Real Estate) +1.77%

Benchmark: $SPY -1.27%

1. $XLF (Financial) -4.78%

2. $XLK (Technology) -2.98%

3. $XLC (Communication) -2.98%

Market Breath (Weekly)

% of Stocks Above 200 DMA = 32.22% (-5.56%)

% of Stocks Above 50 DMA = 32.92% (-10.93%)

Market Technicals – (S&P 500, NASDAQ, Bitcoin, Bonds & Credit Spread, NAAIM)

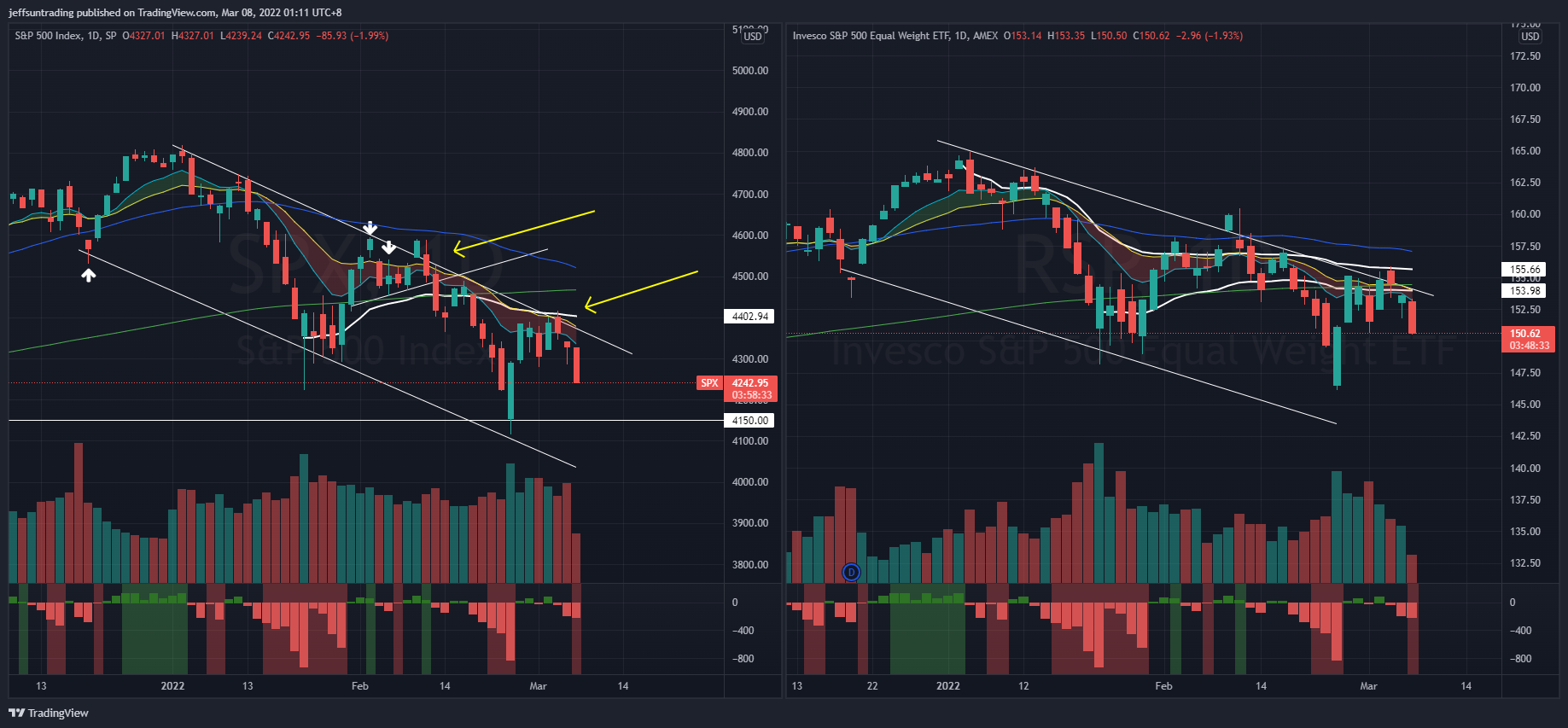

$SPX (S&P 500) vs $RSP (S&P 500 Equal Weight) – (Net High/Low -188)

The S&P 500 ($SPX) ended the lacklustre week with a -1.27% loss, as further spike in oil prices dampens risk sentiment in the market.

$SPX remains trapped beneath its Downtrend Line, with further rejection observed to its declining 20-day moving average (5th attempt). Additionally, $SPX have broken its 4,320 key support in yesterday’s session signifying further weakness in the index to be expected for the remaining of the week.

The immediate support to watch for $SPX this week is at 4,150 level, a 10 months low support that was reclaimed intraday some two weeks ago.

$QQQ (Nasdaq 100) vs $QQQE (Nasdaq 100 Equal Weight) – Downtrend Channel In Play

Tech and growth names have been hard hit since the start of 2022 by a rapid rise in Treasury yields on the back of expectations that the Fed will hike interest rates aggressively to combat high inflation as higher rates can hurt their companies with high valuations based on the prospect of future profits.

$QQQ gave up its earlier gain, losing -2.45% last week. Similar to $SPX, advancement beyond its declining 20-day moving average has been rejected.

The support level to watch for $QQQ this week is at $319.

$BTCUSD (Bitcoin / USD) – Morphing out a Bearish Head and Shoulder Pattern

Bitcoin ($BTCUSD) ended with a modest gain of +1.93% after rallying as much as +19.92% last week. At the current juncture, $BTCUSD remains trading below the convergence of declining moving averages (10, 20 and 50 day), along with its anchored VWAP from 27th December high.

$BTCUSD continues to be morphing out a right side shoulder of a mid-term bearish Head and Shoulder Pattern.

The next level of support to watch for $BTCUSD remains at a re-test of $37,000.

$PCCE (Put/Call Ratio Equity) & $VIX (Volatility S&P 500) – VIX elevated to 52-weeks high

The spike level to watch for $PCCE is at 1.00. The the current reading of 0.751 (-9.30%) further ease pressure on risk sentiment of the market, which contradicts with the rising $VIX level.

$VIX further elevated to an extreme level of 36.44 (+27.81%) that was last witnessed on January 2021, implying risk of a further sell off.

$IEI/$HYG (Credit Spread) – $TNX (10YR Treasury Yield) – Eyes on Spread

Market participants are keeping a close watch on credit spreads as one of the better economic signals. Junk bond issuers are perceived to be bigger credit risks, so if economic growth slows or contracts, there will be increased angst that these issuers won’t be able to make good on their interest payments. Hence, a widening high-yield spread is regarded as a leading indicator of difficult economic times which, in turn, often invites a more challenging period for the stock market since difficult economic times translate into weaker earnings prospects.

Credit Spread rise to 1.54% over the week (+0.04). On the flipside, $TNX have lowered to to 1.752% (-0.233). Buying long-term bonds at current rates may be viewed as a losing proposition when inflation is spiking; subtracting the rate of inflation from the payout might leave an investor small or even zero gains.

NAAIM Exposure Index 44.41 (-14.11)

The NAAIM Exposure Index represents the average exposure to US Equity markets reported by members of the National Association of Active Investment Managers. It provides insight into the actual adjustments active risk managers have made to client accounts over the past two weeks.

This week’s NAAIM Exposure Index number is: 30.30, down from 44.41.

Top Trading Ideas for the Week

$USER new IPO name, sitting on VWAP from IPO after breakout (+27%) from its first quarterly ER this week.

this name has built higher lows since late january, rising 10/20MA momentum. key pivot for further strength is at $11.15 pic.twitter.com/iXvvrIaFDm

— Jeff Sun (@jeffsuntrading) March 4, 2022

$MLI setup remains valid for an entry out of its DTL. this week prints out a new higher low on 1/3, further affirming strength in this name. pic.twitter.com/UhUebth41k

— Jeff Sun (@jeffsuntrading) March 4, 2022

$DDS $225 held again over the last 2 weeks, cont to form a constructive base. prolong coiling action of moving averages could equate to a long sustainable breakout

this is a consumer cynical that is setting up, a sector that is not under limelight atm. do keep in your watchlist pic.twitter.com/JTxl8hL7Hx

— Jeff Sun (@jeffsuntrading) March 1, 2022

Do follow me on twitter for more daily trading ideas.