The U.S. market (NYSE, Nasdaq and Bond market) are closed on Monday for Presidents’ Day holiday.

Markets are increasingly on edge as arrows are being slung by all sides in the tensions around the border between Russia and Ukraine. Risk sentiment was further pressured by disappointing growth-stock earnings reactions.

Concerns over elevated inflation will also remain to the fore with the release on personal consumption expenditures price Index (Core PCE Price Index) along with a string of earnings results from major U.S. retailers. Oil prices will remain in focus.

Here’s what you need to know to start your week.

1. Market Volatility – Russia-Ukraine’s Rising tensions, Speculation on Monetary Policy

There’s been no shortage of volatility in the markets so far this year and it doesn’t look like that is going to change any time soon. The focus has shifted slightly in recent weeks from monetary policy to geopolitics as Russian troops have built up on the Ukrainian border and the West has warned of an imminent invasion.

Ongoing uncertainty over the Federal Reserve’s next policy move is also likely to continue to weigh on equities.

The Fed has signaled that it will hike interest rates at its upcoming meeting in March to bring down inflation, which has surged past the central bank’s 2% target to hit its highest levels in four decades, but it has not indicated how aggressively it will act.

2. Earnings (Retail)

After a strong rebound in January retail sales, consumers are back in focus and a string of earnings results from major retailers this week will be parsed for signs of how surging inflation is affecting spending. Despite the rebound in retail sales, consumer sentiment has dropped to a decade low in recent months leading to fears that the economic recovery could stall.

Home Depot ($HD), Lowe’s ($LOW), Macy’s ($M) and Foot Locker ($FL) are among those scheduled to report Q4’2021 results during this week.

Other notable companies reporting earnings include Alibaba ($BABA), Krispy Kreme ($DNUT) and Beyond Meat ($BYND).

In addition to bottom lines, investors will be looking to see how companies are dealing with the supply chain crunch and their views on inflation.

3. Oil prices

Oil prices could be set for another mixed week as energy traders weigh a potential supply disruption resulting from the Russia-Ukraine crisis against the prospect of increased Iranian oil exports.

Fears over possible supply disruptions from sanctions on top exporter Russia if it attacks Ukraine have supported prices, which have also been underpinned by a recovery in demand from the pandemic.

U.S. crude prices are hovering around $91 a barrel and last week reached their highest level since 2014, while the price for Brent, the global benchmark, is near seven-year highs.

Higher oil prices are contributing to soaring inflation, adding to concerns that the Fed will need to aggressively tighten monetary policy to curb consumer prices.

Key Economic Calendar (Weekly)

Amid speculation over the prospect of a half percentage point rate increase from the Fed in March Friday’s data on the personal consumption expenditures price index will be closely watched.

The PCE price index, rumored to be the Fed’s favorite inflation measure is forecast to have risen 6% year-over-year in January, while the core reading, which excludes food and fuel prices, is expected to rise 5.2%.

All times listed are EST

Monday

President’s Day Holiday in the US – US Markets Closed

Thursday

8:30: US – Prelim GDP: probably edged higher, to 7.0% from 6.9%.

8:30: US – Initial Jobless Claims: predicted to decline to 235K from 248K.

10:00: US – New Home Sales: expected slip to 807K from 811K.

Friday

8:30: US – Core PCE Price Index: anticipated to maintain at 0.5%

10:00: US – Pending Home Sales: forecast to jump to 0.5% from -3.8%.

Top 3 Leading and Lagging Sectors (Weekly)

The energy sector ($XLE) was the weakest performer with a -3.35% decline as oil prices ($91.21, -2.0%) briefly fell below $90 per barrel amid reports indicating that a nuclear agreement with Iran was within reach.

The consumer staples sector ($XLP) was the only sector that closed higher with a gain of +1.04%.

1. $XLP (Consumer Staples) +1.04%

2. $XLB (Materials) -0.17%

3. $XLY (Consumer Discretionary) -0.27%

Benchmark: $SPY -1.41%

1. $XLE (Energy) -3.35%

2. $XLC (Communication Services) -2.74%

3. $XLF (Financial) -2.22%

Market Breath (Weekly)

% of Stocks Above 200 DMA = 34.29% (+0.03%)

% of Stocks Above 50 DMA = 35.54% (-0.14%)

Market Technicals – (S&P 500, NASDAQ, Bitcoin, Bonds & Credit Spread, NAAIM)

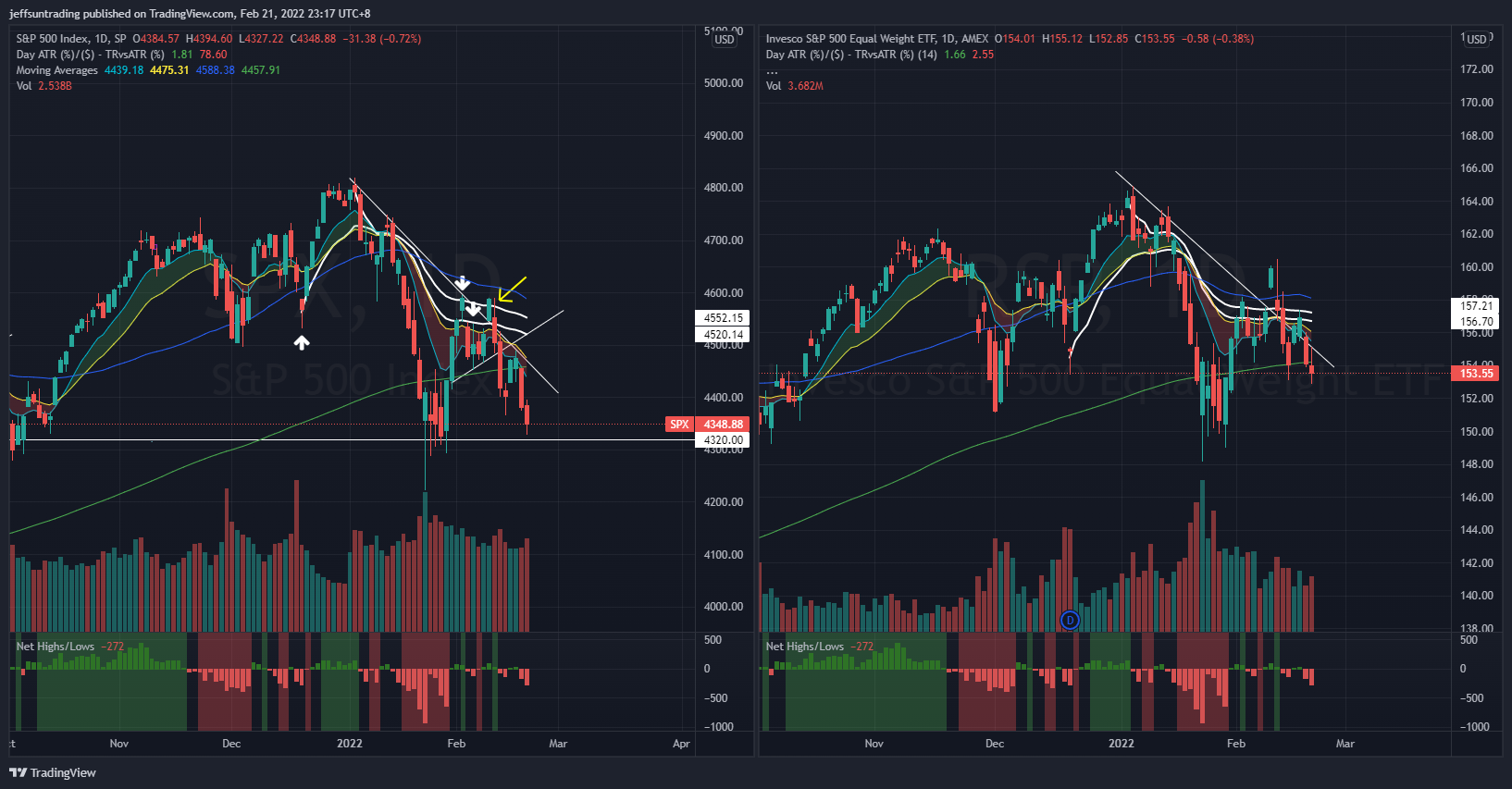

$SPX (S&P 500) vs $RSP (S&P 500 Equal Weight) – (Net High/Low -272)

$SPX fell further with a loss of -1.58% last week, driven primarily by worsening Russia-Ukraine developments. Risk sentiment was further pressured by disappointing growth-stock earnings reactions and lingering concerns about a Fed policy mistake. 10 of the 11 S&P 500 sectors ended the week in negative territory.

With a considerable loss of -1.58% over the week, improved posture in weekly market breath is actually observed as below;

- % of Stocks Above 200 DMA = 34.29% (+0.03%)

- % of Stocks Above 50 DMA = 35.54% (-0.14%)

$SPX remains resisted by a Downtrend Line, along with its 200-day moving average.

The immediate support to watch for $SPX this week remains at 4,320 level. A breach of 4,320 level would be concerning in mid-term as it would confirm the establishment of a downtrend channel (lower highs, lower lows) on $SPX.

$QQQ (Nasdaq 100) vs $QQQE (Nasdaq 100 Equal Weight) – Below All Major Moving Averages

Tech and growth names have been hard hit since the start of 2022 by a rapid rise in Treasury yields on the back of expectations that the Fed will hike interest rates aggressively to combat high inflation as higher rates can hurt their companies with high valuations based on the prospect of future profits.

$QQQ loss -1.60% last week with $QQQE also losing -2.03%, further pressured by disappointing growth-stock earnings reactions.

Both $QQQ and $QQQE remains below their major moving averages.

The support level to watch for $QQQ remains at $340. Similar to $SPX, a breach of the mentioned support level would be concerning in mid-term as it would confirm the establishment of a downtrend channel (lower highs, lower lows),

$BTCUSD (Bitcoin / USD) – Morphing out a Bearish Head and Shoulder Pattern

Bitcoin ($BTCUSD) endured a substantial sell off, correcting a further -8.80% over the week, breaking the convergence of support from declining moving averages (10, 20 and 50 day) at key support level of $40,990 highlighted last week.

$BTCUSD is currently morphing out a right side shoulder of a mid-term bearish Head and Shoulder Pattern.

The next level of support to watch for $BTCUSD is at $37,000.

$PCCE (Put/Call Ratio Equity) & $VIX (Volatility S&P 500) – Risk of a Further Sell Off in the Market

The spike level to watch for $PCCE is at 1.00. The the current reading of 1.04 (+7.75%) has fuelled pressure on the risk sentiment of the market.

$VIX have also creep up further to 27.74 (+1.43%), remaining outside of its 24.50 upper boundary implying risk of a further sell off.

$IEI/$HYG (Credit Spread) – $TNX (10YR Treasury Yield) – Eyes on Spread

Market participants are keeping a close watch on credit spreads as one of the better economic signals. Junk bond issuers are perceived to be bigger credit risks, so if economic growth slows or contracts, there will be increased angst that these issuers won’t be able to make good on their interest payments. Hence, a widening high-yield spread is regarded as a leading indicator of difficult economic times which, in turn, often invites a more challenging period for the stock market since difficult economic times translate into weaker earnings prospects.

Credit Spread lowered to 1.51% over the week (-0.01). Similarly, $TNX have also lowered to 1.931% (-0.025).

Even if 10-Y yields slip back toward 1.8%, it is expected that such a decline to be short-lived, following back-to-back continuation patterns we witnessed since July 2021.

NAAIM Exposure Index – 53 (-13.8)

The NAAIM Exposure Index represents the average exposure to US Equity markets reported by members of the National Association of Active Investment Managers. It provides insight into the actual adjustments active risk managers have made to client accounts over the past two weeks.

This week’s NAAIM Exposure Index number is: 53, down from 66.8.

Top Trading Ideas for the Week

$NI traded through the week without closing below Monday’s low (daily average $ volume of $100mil), displaying resilience to the general market weakness.

Currently a bullish flag formation, sitting on confluence of VWAP (from previous low) and 10/20 MA.

23/2 ER pic.twitter.com/q9aIb044o2

— Jeff Sun, CFTe (IFTA) (@jeffsuntrading) February 18, 2022

$SRTS flagging on 2 days of market weakness, volume contraction observed. RS is beyond ATH compared to its price. pic.twitter.com/bb2pVlNbcJ

— Jeff Sun, CFTe (IFTA) (@jeffsuntrading) February 17, 2022

$ANET display a rare behavior you could find, resilient to months of market weakness frm its previous ER gap up (Q3) in Nov’21.

a siew of recent VWAPs have coincide to resist $ANET at $128 last week. actionable on VWAP breakout

Q4’21 ER YoY

EPS 0.82 (+32%)

Sales 784mil (+15%) pic.twitter.com/imGoIsdFJG— Jeff Sun, CFTe (IFTA) (@jeffsuntrading) February 15, 2022