All eyes turn to the US July jobs report due this Friday, with investors on the watch for any catalysts that could encourage the Federal Reserve to tighten monetary policy sooner.

Earnings will continue to dominate headlines, with more than a quarter of S&P 500 companies set to report this week. Berkshire Hathaway ($BRK.A), General Motors ($GM) and Uber ($UBER) are the headlining companies due to report their quarterly result.

The crackdown by Chinese market regulators could continue to be a major story and in the UK the Bank of England is to hold its latest policy meeting where it is likely to echo the Fed’s view that there is still some way to go before stimulus can be reduced.

Here is what you need to know to start your week.

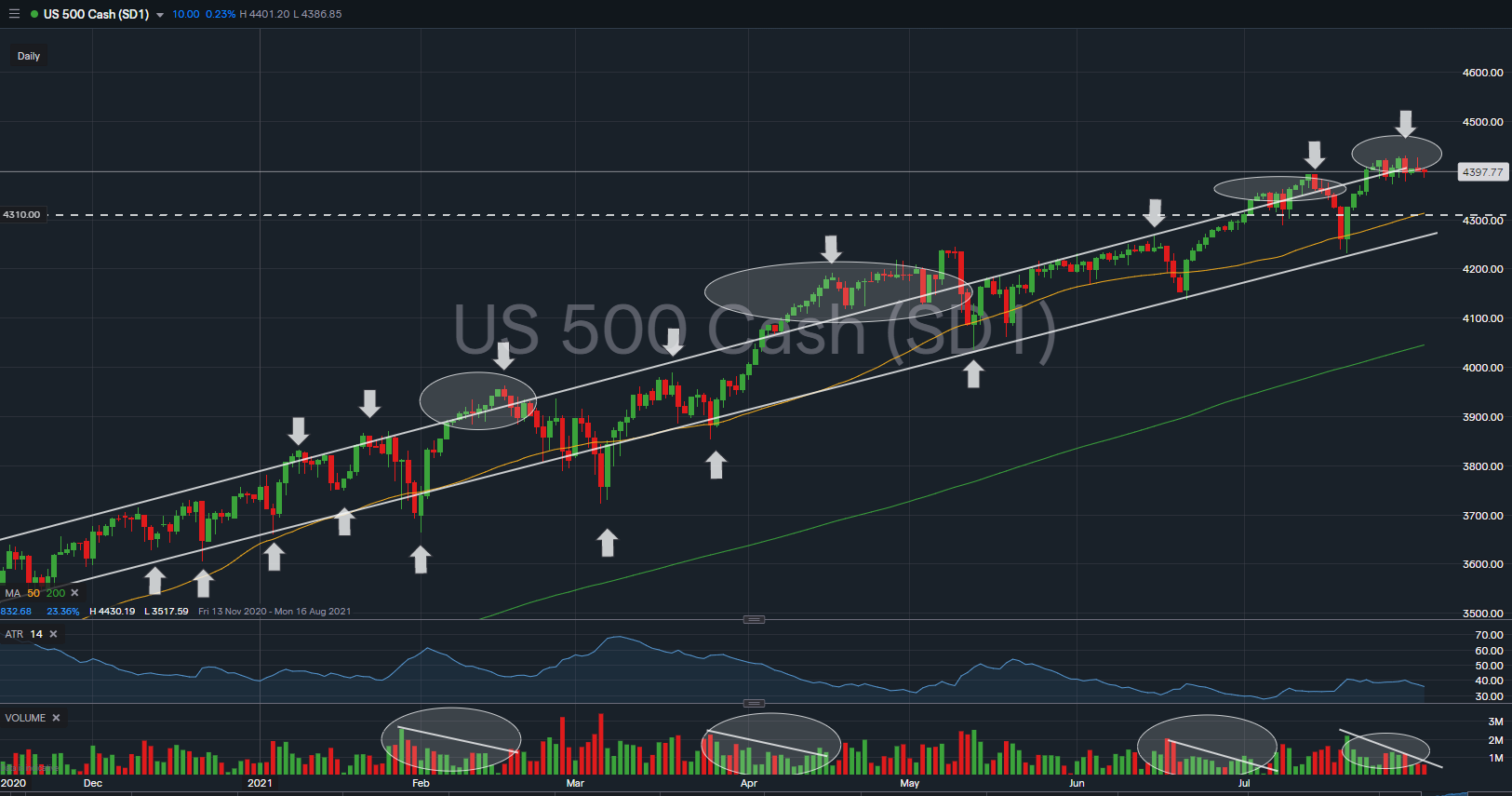

The benchmark index $SPX ended the week with a muted -0.10% (-4.3 points), closing near its peak at 4,400 level. $SPX remains above its multi-month long trend channel that was earlier highlighted. Every break out of $SPX trend channel resistance has been met with a rejection (6 times since 2021).

The immediate support to watch for $SPX this week is revised up to 4,310 level; the 50DMA short term support level, along with a 75% retracement within its trend channel.

July jobs report

Friday’s U.S. non-farm payrolls report will provide fresh clues on the strength of the economic recovery and inform the outlook for Fed policymakers.

Economists are expecting the economy to have added 900,000 jobs in July after a forecast-beating 850,000 in June.

Last week Fed Chair Jerome Powell said the job market still had “some ground to cover” before it would be time to start scaling back stimulus measures the central bank enacted in the spring of 2020 to combat the economic fallout from the coronavirus pandemic.

In June Fed officials began debating how to wind down bond purchases but there is no clear timetable yet for when it will begin pulling back emergency market support measures.

Earnings

Investors will get a fresh batch of earnings reports in the week ahead from companies such as Eli Lilly ($LLY), CVS Health ($CVS) and General Motors ($GM).

Expectations of strong future earnings have been the key driver of the S&P 500’s gains this year, according to a Credit Suisse analysis of the index’s year-to-date performance that compared change in stock valuations with changes in expected earnings.

U.S. stocks fell on Friday and registered losses for the week as Amazon ($AMZN) shares dropped after the company forecast lower sales growth, but the S&P 500 still notched a sixth straight month of gains.

China crackdown

China’s recent regulatory crackdown has frightened investors away from Chinese stocks and left tech companies operating in an uncertain environment.

China has been tightening its regulatory grip on overseas share issuance after it launched a probe of ride-hailing giant Didi Global last month, just days after its listing in New York.

Following a sharp selloff authorities moved to calm market jitters which put a floor under stocks and the yuan, for now.

In the coming week investors will be looking to Chinese PMI data amid growing concerns over a slowdown in the world’s second largest economy, which could be the next test for markets.

Bank of England meeting

The Bank of England is expected to keep stimulus running at its current pace when it meets on Thursday, despite some disagreement among policymakers over the size of its bond-buying program against a background of rising inflation and an improving economy.

Officials are likely to raise their inflation forecast for this year, but the outlook for growth remains uncertain amid concerns over the delta variant.