The main theme for the financial markets in the week ahead will revolve around the renewed hopes for economic stimulus and the beginning of the vaccine rollout. Wall Street’s main indexes jumped to all-time highs on Friday session, but pressure mounting in Washington to help people and businesses hit hard by the pandemic, with the economy suffering its worst downturn in decades.

In Europe, long running Brexit talks are entering the final stages and the European Central Bank will likely announce another stimulus expansion on Thursday as the pandemic continues to ravage the euro area economy. Here’s what you need to know to start your week.

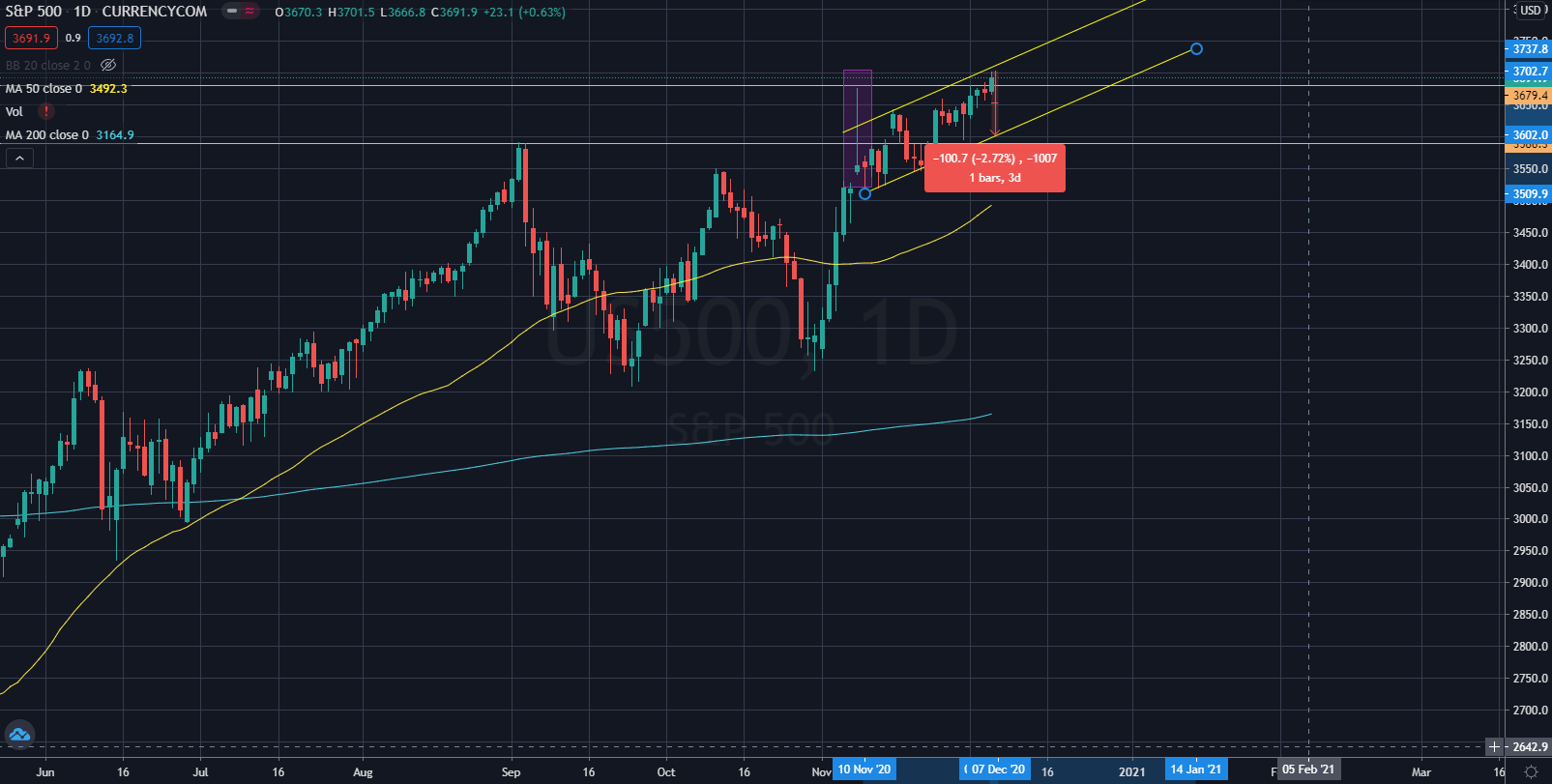

S&P 500 (US Market)

The US stock market reopens tomorrow, entering into the second week of December. Many market participants would probably look forward to their socially-distanced holiday gathering without wild swings to worry about.

The benchmark index rallied a further 1.4% (+50.9 points), breaking its all time high on friday’s trading session. The same applies to all the remaining 3 major indices (Dow Jones 30, NASDAQ Composite 100 and Russell 2000). This breakout of all time high has successfully negated the Bearish Shooting Star Candlestick Pattern (highlighted) that has been in play for the past three weeks.

At the current junction, S&P 500 is trading within a very tight 3% trend channel range established since 10th November. As market tends to go through a mid-December low; coupled with low volume trade as we are approaching the holiday season, we are likely to see minor decline during the next two weeks. This is not concerning if the decline respects within the established uptrend channel highlighted.

The immediate support to watch is 3,588 classical support level.

STI30 (Singapore Market)

1. Stimulus talks gain momentum

Data on Friday showing the slowest U.S. jobs growth in six months reinforced investors’ expectations for a new fiscal stimulus bill to help revive the economy. Over 13 million people are due to lose unemployment benefits on Dec. 26 without quick action by Congress.

A $908 billion coronavirus aid plan gained momentum in the Congress on Friday after a months-long standoff between Republicans and Democrats over the size of the potential package.

2. Vaccine rollout to begin

The UK is preparing to become the first country to roll out the vaccine developed by Pfizer (NYSE:PFE) and BioNTech (NASDAQ:BNTX) this week as governments around the world enter a new stage in tackling the pandemic.

The first doses are set to be administered on Tuesday, with top priority being given to the over-80s, frontline healthcare workers and care home staff and residents.

Britain gave emergency use approval for the Pfizer/BioNTech vaccine last week – jumping ahead in the global race to begin the most crucial mass inoculation program in history.

In the U.S., the Food and Drug Administration is to vote on emergency-use authorization for the Pfizer/BioNTech vaccine on Thursday and initial vaccinations could get underway as early as Friday with hopes to reach around 20 million people by year-end.

3. ECB to announce another stimulus expansion

With the euro zone heading back into recession in the fourth quarter, European Central Bank President Christine Lagarde is expected to announce another expansion of its stimulus package on Thursday.

Euro zone inflation remained in negative territory for the fourth straight month in November, underlining concerns that the dip in prices may be more persistent than feared.

Inflation is likely to be the main discussion at Thursday’s meeting as policymakers are increasingly worried that a deep and lengthy recession makes deflationary forces more permanent.