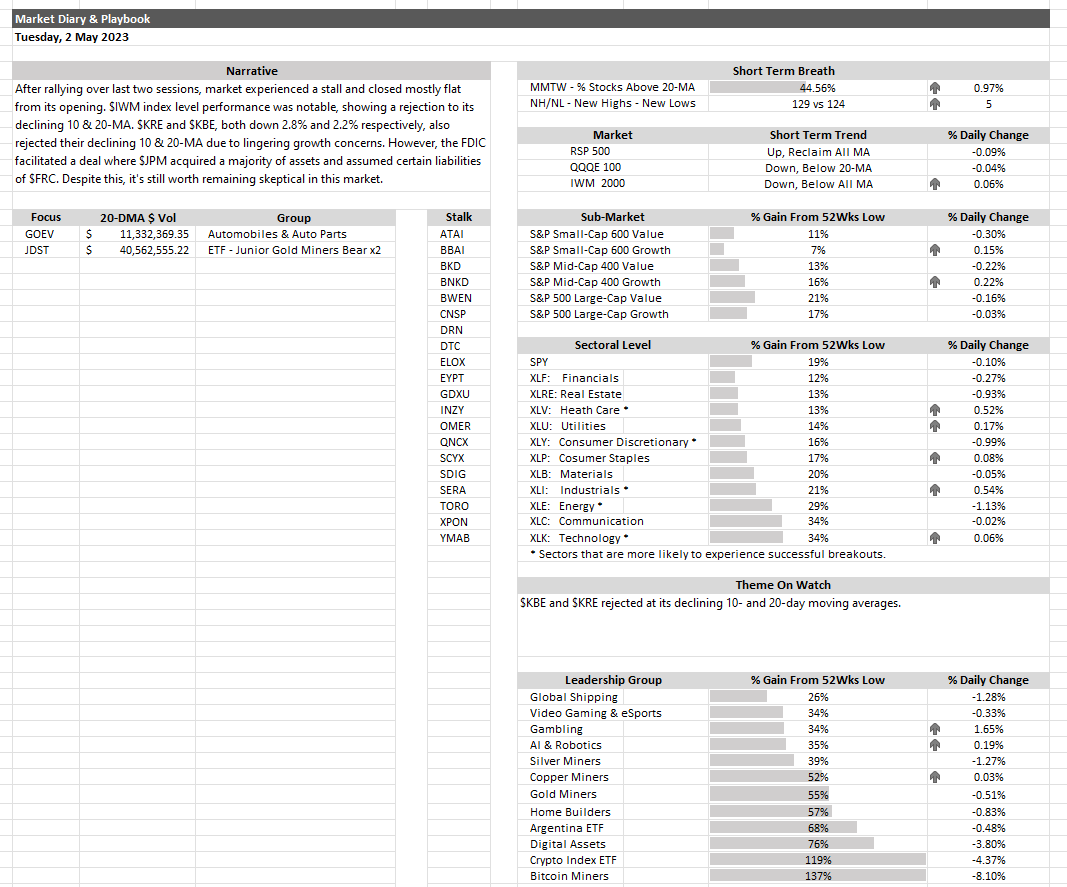

After rallying over last two sessions, market experienced a stall and closed mostly flat from its opening. $IWM index level performance was notable, showing a rejection to its declining 10 & 20-MA. $KRE and $KBE, both down 2.8% and 2.2% respectively, also rejected their declining 10 & 20-MA due to lingering growth concerns. However, the FDIC facilitated a deal where $JPM acquired a majority of assets and assumed certain liabilities of $FRC.

Despite this, it’s still worth remaining skeptical in this market.

Thanks for reading.

PS: If you enjoy the above curated article, you may follow me on twitter (@jeffsuntrading) to get daily market diary, trading ideas and intermittent reflection on life as a trader.

2/5/2023 Market Diary

1. Market experienced a stall and closed mostly flat from its opening. $IWM index level performance was notable, showing a clear rejection to its declining 10 & 20-MA.

2. $KRE and $KBE, both down -2.8% and -2.2% respectively, also rejected their declining… pic.twitter.com/LSiom7UtYl

— Jeff Sun, CFTe (@jeffsuntrading) May 2, 2023