September 2021 (Month #59)

Total Trades: 38 (MTM -7)

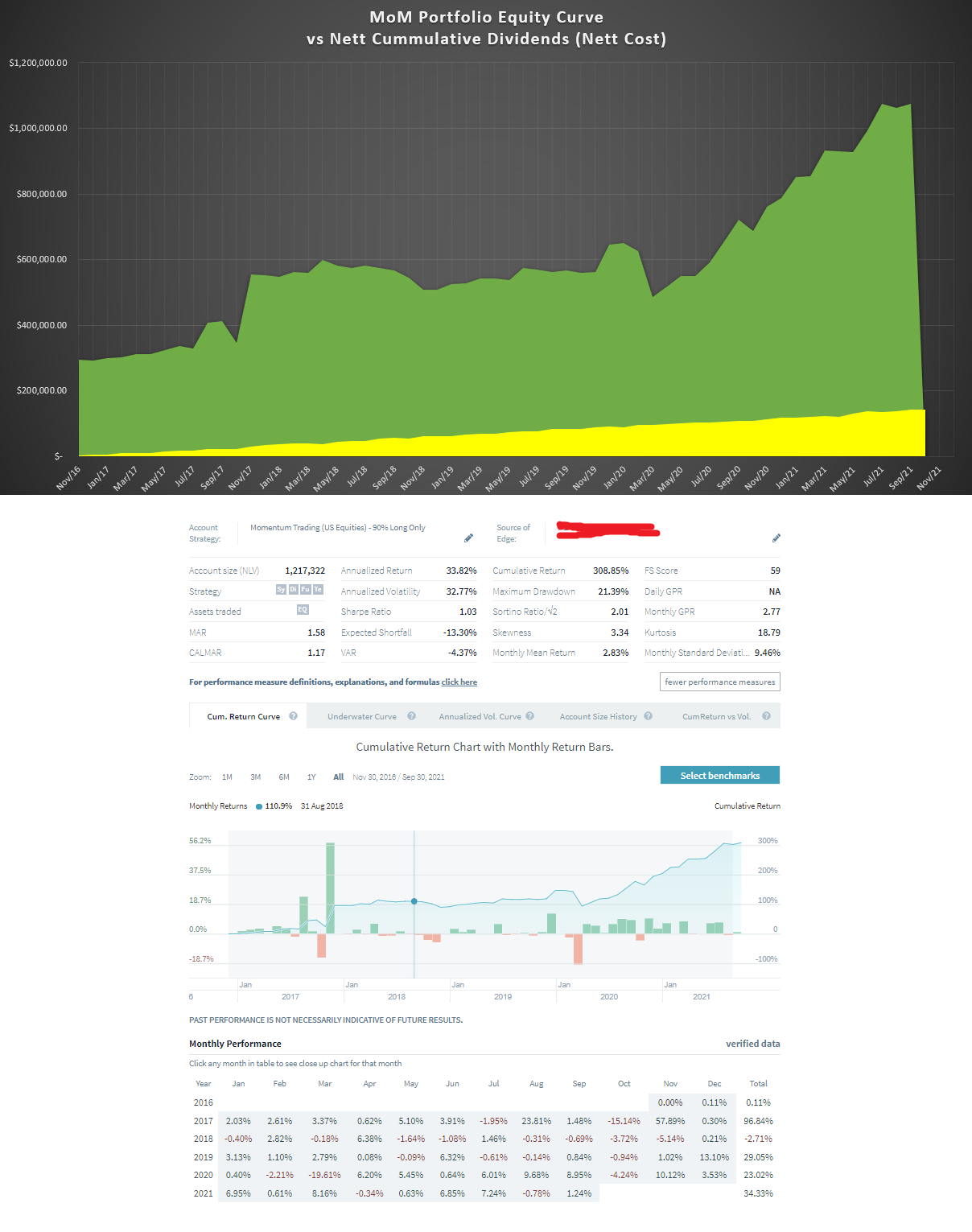

September Month Return: +1.24% (YTD: +34.33%)

September Absolute Gain (Loss): +$14,882.90

September Month Nett Dividends: +$4,498.28

Cumulative Return: +308.85% (Annualized: +33.82%)

Monthly Mean Return: +2.83% (MTM -0.02%)

Monthly Standard Deviation: 9.46% (MTM -0.08%)

Maximum Drawdown: 21.39% (Skewness: 3.34)

Sharpe Ratio 1.03

Odds are clearly against trading stocks outside of Energy Select Sector ($XLE) in September. Energy stocks was the only positive with a month gain of +13.2%, vs benchmark index $SPX -4.88%.

This is definitely the time to do the necessary risk exposure reduction, and stay patient until clear signs of a reversal is reflected in your watchlist of stocks. When the probabilities are high to catch a big winner you should trade, else just remain conservative and defensive with risk management and capital deployment.

Making money in the stock market is a marathon, not a sprint. Probabilities and risk first, stocks second.