Third-quarter earnings season gets underway with major banks; JPMorgan Chase ($JPM), Bank of America ($BAC), Wells Fargo ($WFC), Morgan Stanley ($MS) and Goldman Sachs ($GS) reporting later in the week. It is also a relatively busy week ahead on the economic data front with inflation driven US Consumer Price Index report (Wednesday) for September will will be closely watched while minutes from the last FOMC meeting (Thursday) is also set to be under Investors’ radar for further cues on the Fed’s tapering timeline.

Here’s what you need to know to start your week.

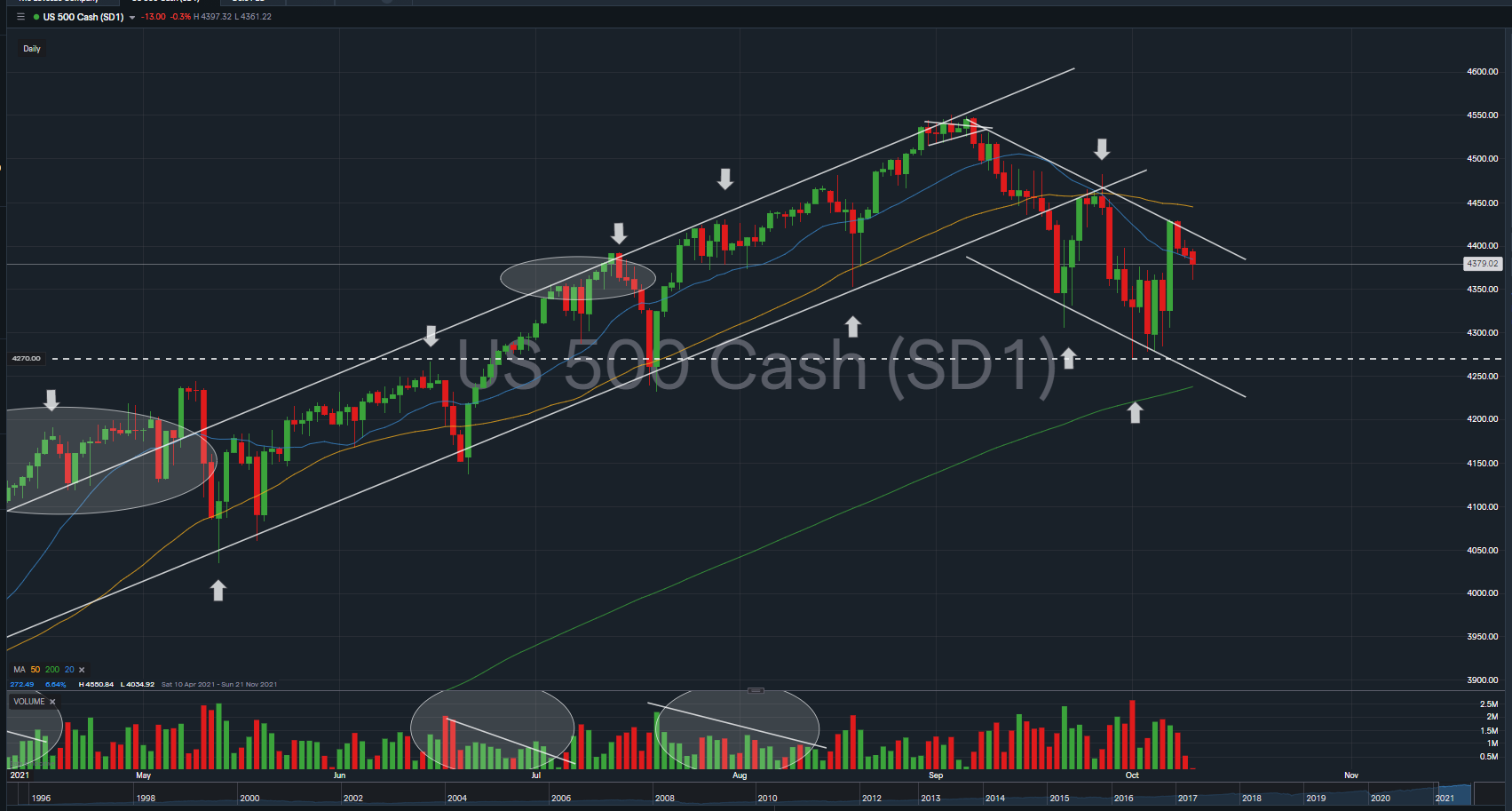

- $SPX Short Term MA Crossover of 20 Days and 50 Days (technically known as ‘Death Cross’), last observed on 30th September 2020

- $SPX multi-month long uptrend channel violation, observation of first lower high and lower low established below 20D and 50D MA over the period

- Up-Down Volume ratio is significantly much lesser than 1.0 over the past 30 days average (A ratio greater than 1.0 shows more volume on the upside than on the downside. A reading under 1.0 shows sellers have the upper hand.)

The immediate support to watch for $SPX this week remains at 4,270 immediate support level. A breakdown of 4,270 support level would point to further weakness for the month of October, which is considered to be a time when stocks historically decline, giving rise to the term the ‘October Effect.’

Bank earnings

Some of the world’s biggest banks kick off U.S. earnings, with investors focused on global supply chain problems, labor shortages and the upcoming tapering of the Fed’s $120 billion monthly stimulus.

Banks smashed profit estimates in the second quarter as the economy rebounded, with Wells Fargo ($WFC), Bank of America ($BAC), Citigroup ($C) and JPMorgan Chase ($JPM) posting a combined $33 billion in profits.

That momentum likely slowed in the third quarter; earnings for financials are forecast to grow by 17.4%, versus nearly 160% in Q2, according to I/B/E/S data from Refinitiv.

U.S. data

The key U.S. economic report to watch this week is Wednesday’s data on consumer price inflation for September. While the rate of price increases has moderated inflation is still higher than it was pre-pandemic with the surge in demand after the economy reopened pushing up prices.

Economists expect the consumer price index to match August’s 0.3% monthly increase and the 5.3% annual gain.

Producer price inflation figures are due out on Thursday, followed by data on retail sales on Friday. Retail sales are expected to be pulled lower because of a plunge in vehicle sales amid supply chain bottlenecks, but excluding vehicles, retail sales are forecast to increase.

Fed minutes

The Fed is to publish its September meeting minutes on Wednesday amid expectations that it will begin tapering asset purchases before the end of this year, an important first step towards eventual rate hikes.

Friday’s weaker-than-expected September jobs report did little to alter expectations the Fed could begin to scale back stimulus by the years end.

Though the economy added just 194,000 jobs in September upward revisions to prior months’ data meant that all told the economy has now regained half of the jobs deficit it faced in December, compared with pre-pandemic employment levels.

Fed Chair Jerome Powell said last month that he’d only need to see a “decent” September U.S. jobs report to be ready to begin to taper in November.