A big week for earnings, including reports from Amazon ($AMZN), Alphabet ($GOOGL), Exxon Mobil ($XOM) and Pfizer ($PFE). Stimulus negotiations in Washington and the first jobs report of 2021 (January) will all be major events to watch in the coming week, but they are likely to be overshadowed by the standoff between retail investors and Wall Street hedge funds. Investors will be watching closely to see if the short squeezes driven by retail investors continue in what could be a bumpy week for stocks.

Here’s what you need to know to start your week.

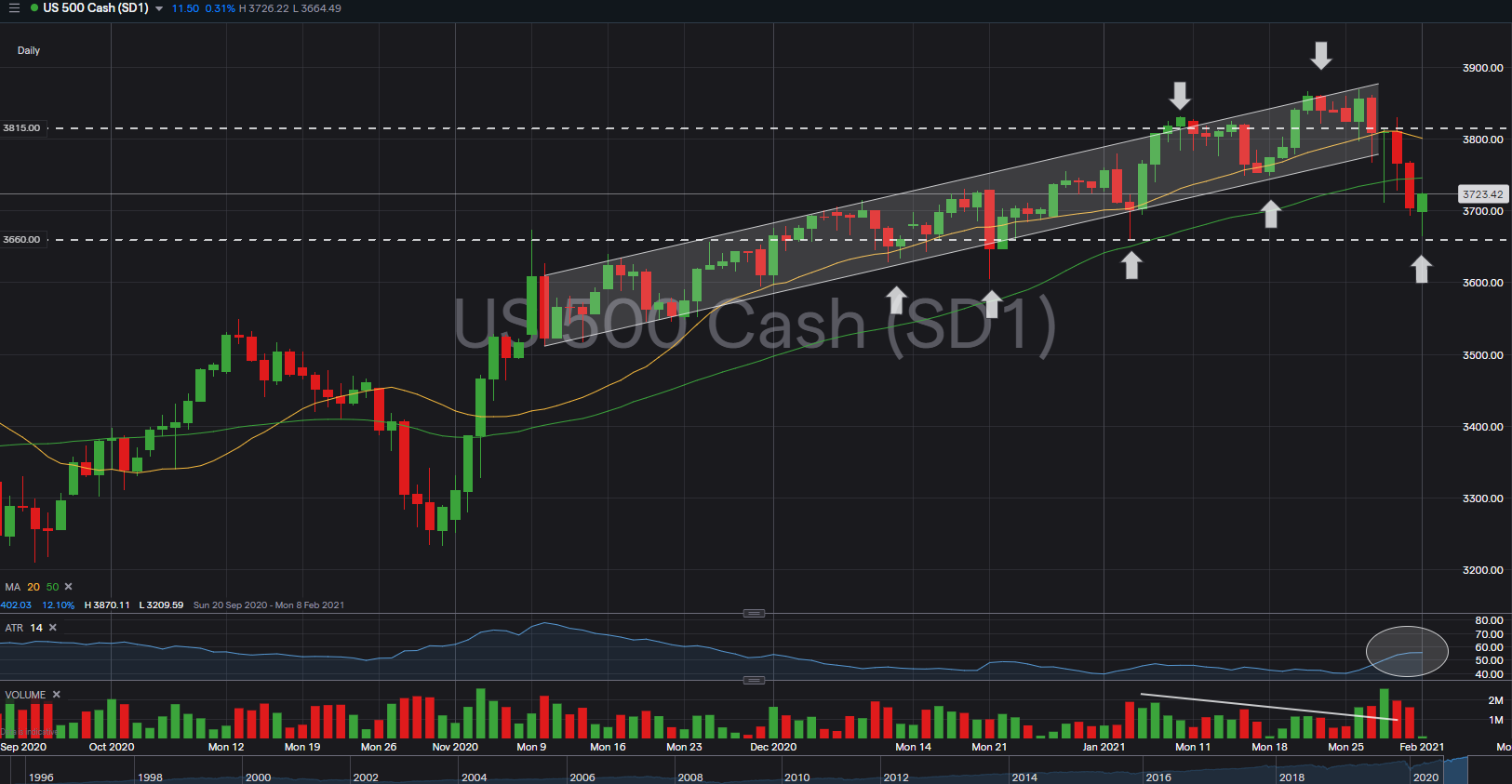

S&P500 (US Market)

The benchmark index ($SPX) ended the January flat, with a weekly loss of -3.47%. The correction have breached the multi-month long Trend Channel, along with 20SMA support convincingly, with the month’s highest transactional volume witnessed on 28th January. Additionally 50SMA was also breached on Friday session. This pullback affirms the technical Bearish Divergence between price rally and volume decline highlighted last week.

At the current junction, $SPX remains trading above 3,660 level, a classical support level established at the start of 2021. The breach of this support will see S&P500 trades at a cumulative loss for 2021.

1. The big squeeze

Last week saw retail investors using Robinhood and other apps drive a frenzied rally in shares of GameStop ($GME), AMC ($AMC) and other companies championed on social media platforms including Reddit’s WallStreetBets, that had been heavily shorted by hedge funds.

U.S. stock indexes suffered their biggest weekly fall since late October as the short squeezes saw hedge funds sell stocks to cover their losses, despite positive earnings results from market heavyweights like Apple ($AAPL) and Microsoft ($MSFT).

Some market watchers are concerned that the wild rally may be a fresh sign of overexuberance that could foreshadow volatility for the broader stock market, while others believe it is more of a sideshow.

2. Earnings

With quarterly earnings season in full swing, market participants are looking at whether companies can justify high valuations.

“By and large the surprises have been positive, even more so than typical and by and large companies are showing positive operating leverage where they are able to grow earnings a little bit faster than they are able to grow revenue,” said Ellen Hazen, portfolio manager at F.L.Putnam Investment Management in Wellesley, Massachusetts.

Tech giants Alphabet ($GOOGL) and Amazon ($AMZN) are both due to report after the market close on Tuesday, followed by Qualcomm ($QCOM), Snap ($SNAP) and Pinterest ($PINS) later in the week.

Some big names in the closely watched healthcare sector are also to report, including Pfizer ($PFE), GlaxoSmithKline ($GSK), AbbVie ($ABBV), Biogen ($BIIB), Gilead Sciences ($GILD), Merck ($MRK) and Bristol-Myers Squibb ($BMY).

3. January jobs report

The January nonfarm payrolls report will give markets the first look at the health of the labor market inherited by U.S. President Joe Biden.

The report is expected to show a slight uptick in hiring after the economy shed 140,000 jobs in December (mostly from restaurants and bars), but more substantial improvements are unlikely to come until there is a broader re-opening of the economy. The unemployment rate is expected to remain unchanged at 6.7% – almost twice the level that it was just prior to the pandemic.

Federal Reserve Chairman Jerome Powell last week said that the economic recovery hinges on the progress of the vaccination rollout. “There’s nothing more important to the economy than people getting vaccinated,” Powell said.