A wholesome of positions into high momentum china securities since middle of November was key to the realized performance for the month. But it is worth to note that I gave up a profit loss of almost 2.5% equity at the peak unrealized profits of my positions prior to 28th December pullback in the market. That is equivalent to a profit loss of -13R in a single trading session.

Some of the notable china partial/realized winners include $TUYA, $GOTU, $GOTU (Short),$TAL, $CWEB, $MLCO, $QFIN, $RLX, $GLDG, $YMM, $RLX

Other notables partial/realized winners includes $NINE, $PDSB, $IMVT, $LUNA (Home Run), $PMTS

Major loss exceeding 2R from pre-session gap includes: $TMF, $LI, $MNSO, $FXI, $CWEB, $OILD

I have also entered in the upcoming 2023 US Investing Championship for the third consecutive year. Will be making several tweaks to my money management method (R % of equity, fractional % to Kelly Criterion calculation etc) along with segregating sell rules of winning trades via designing sell stop trailing days, price areas, moving average that will not be held in conjunction of each other.

Thanks for reading.

PS: If you wish to keep track of my daily trading playbook and diary, you may follow me on twitter (@jeffsuntrading) to get my trading ideas, thought processes and key market updates.

December 2022 (Month #74)

Total Trades: 74 (YTD 433 Trades)

Month Absolute Gain (Loss): +$46,292.91 (YTD $142,228.50)

Month Nett Cost After Dividends: +$2,580.63 (YTD $47,373.27)

Month Return: +3.41% (YTD: +11.28%)

Month Nett R: 17.9

Month % R (Fractional Kelly C): 0.19%

Month Win Rate: 37.01%

Month Gain to Pain: 2.16

Month Profit Factor: 5.93

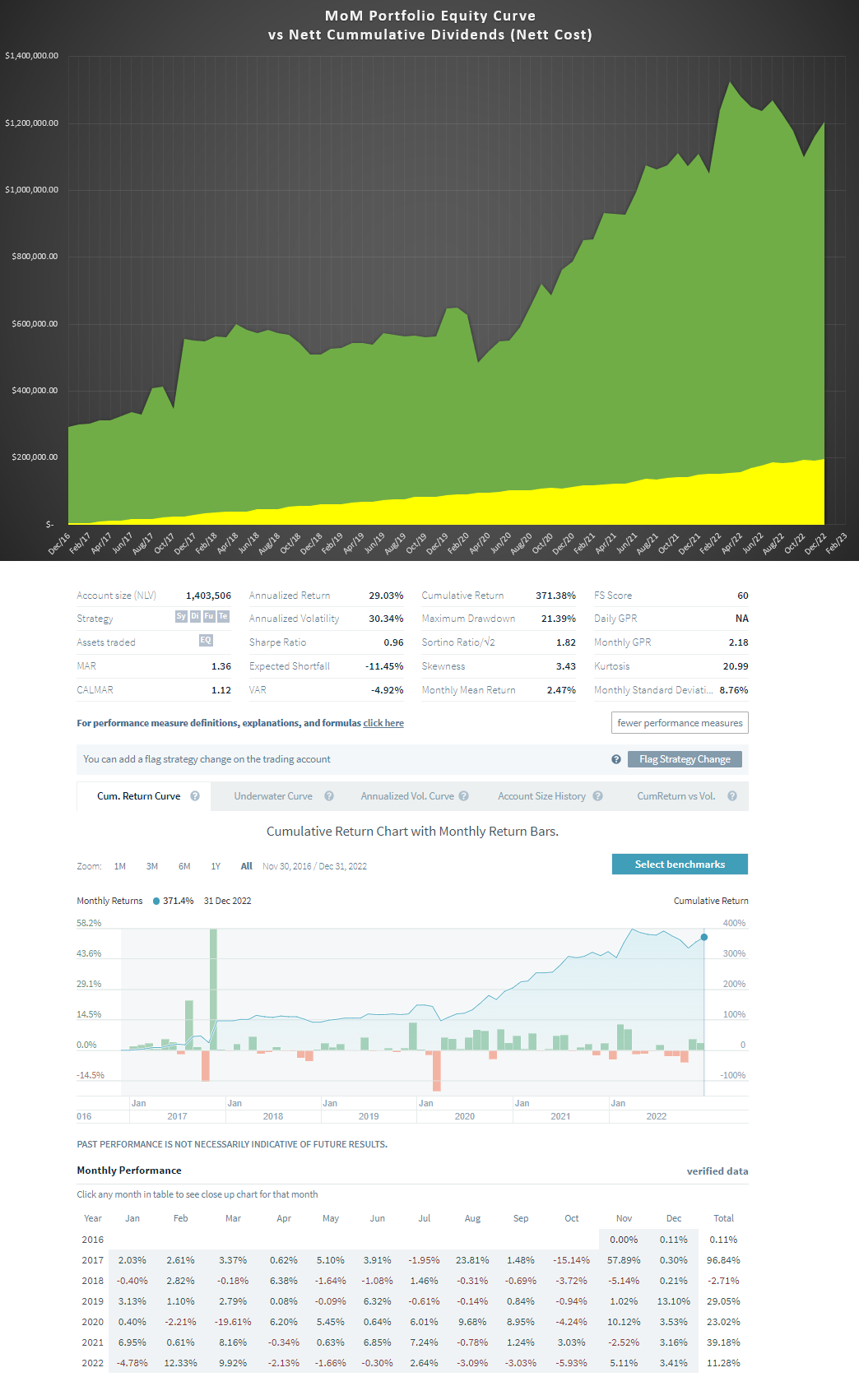

Cumulative Return: +371.38% (Annualized: +29.03%)